Uncategorized

Clues to the conundrum of low forbearance

admin | June 5, 2020

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

With US unemployment in the low teens for April and May, the Mortgage Bankers Association May 24 report of 8.46% forbearance across all US mortgages seems surprising. Borrowers can get forbearance without documenting hardship, see no impact on their credit rating and could get the forbearance deferred interest-free to the end of their loan. It seems every unemployed borrower and a good share of employed ones might ask for that deal. A number of things could explain the conundrum of low forbearance, but the most compelling is a combination of culture and government support, making forbearance sensitive to possible changes in that support in June and July.

A culture of staying current on debt, if possible

Much higher rates of forbearance would seem to make sense at current rates of unemployment. Forbearance would improve liquidity for unemployed borrowers and borrowers working at reduced wages, and they could take the forbearance and put it in the bank for repayment later.

In conversations with originators about borrower response to government and conventional forbearance programs shortly after they began, many pointed out that borrowers typically prefer to keep making payments if they can afford it. Borrowers would rather stay current than set aside cash and repay forbearance later, presumably worried they might spend some or all of the reserve. Most borrowers also have taken less than the initial 180 days of forbearance allowed by the CARES Act. And many borrowers that currently have forbearance still keep making payments, using forbearance as a backstop if they find themselves unemployed or otherwise unable to pay.

A surge in public benefits

A surge in public benefits lately has made it easier for borrowers to afford payments. Personal income in April rose 10.5%, according to the latest figures from the Commerce Department, lifted by almost $3 trillion in government transfers. Most of the money came from $1,200 checks sent by the federal government to millions of households. The CARES Act has also added $600 a week to all state unemployment benefits through July 31. The Paycheck Protection Program or PPP has distributed $659 billion to small businesses to keep payrolls intact, although some employees may work at reduced wages.

Linking forbearance across residential, multifamily and loan balances

Beyond forbearance in residential loans, forbearance has been low in multifamily loans and in smaller residential loans. Forbearance in Fannie Mae’s multifamily loans has reached only 1.2% so far with Freddie Mac’s at 2.4%, despite the likelihood that rates of unemployment are higher among renters than homeowners. The average multifamily loan has a debt service coverage ratio of 1.3x, however, which may be cushioning the impact of tenants unable to make rent. Also interesting, average rates of delinquency, which proxy for forbearance in the agency mortgage market, rise with average loan balance.

Low rates of general forbearance and even lower rates among renters and borrowers with small mortgages could be explained by public benefits. Those benefits make it easier for all borrowers to afford payments, and even easier for renters and borrowers with smaller payments.

Testing the theory that public benefits lower forbearance

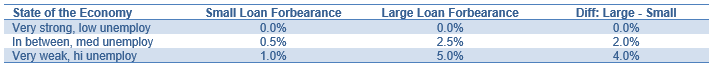

If public benefits make it easier for borrowers to afford mortgage payments and reduce forbearance uptake, one place to see that would be in the forbearance rates of small loans and large loans as unemployment rises. To get intuition for that, consider a simple thought experiment (Exhibit 1):

- Assume that in a very strong economy with little unemployment, both small loans and large loans have the same level of forbearance, say 0%.

- In a very weak economy with lots of unemployment, small loans have low forbearance, say 1%, because public benefits allow most to stay current while larger loans have higher forbearance, say 5%, because the benefits do not cover enough of the mortgage cost.

- As the economy moves from very strong to very weak and unemployment rises, the difference between forbearance rates in small loans and large loans gets bigger, rising from a difference of 0% in a very strong economy to 4% in a very weak economy.

Exhibit 1: A though experiment: how unemployment might increase differences in forbearance between smaller and larger loans

Source: Amherst Pierpont Securities

Forbearance and unemployment rates across states in April offer one place to test the theory. In moving from states with relatively low unemployment to states with relatively high unemployment, forbearance rates in small loans should rise relatively slowly and in larger loans relatively quickly.

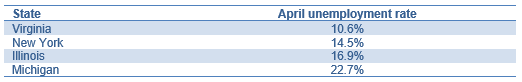

Virginia, New York, Illinois and Michigan offer good test cases. April unemployment rates varied significantly across those states, ranging from a low of 10.6% in Virginia to a high of 22.7% in Michigan (Exhibit 2). Those states also have a broad range of loan balances with enough observations for reliable conclusions. The public benefit theory would predict the forbearance curve between the smallest and largest loans would rise and steepen in moving between Virginia and Michigan.

Exhibit 2: April unemployment rates varied significantly across selected states

Source: Bureau of Labor Statistics

Using April delinquency rates in FHA loans as a proxy for forbearance to test the theory, the forbearance curve in fact does rise and steepen in moving between Virginia and Michigan (Exhibit 3). For loans with a balance near $100,000, all four states are in a range between 7% and 9%. For loans with a balance near $250,000, where all states have data, the range expands to between 15% and 24% with Virginia on the low end and Michigan on the high end.

Exhibit 3: The April delinquency curve across loan balance in FHA broadly rises and steepens with state unemployment rates

Source: Ginnie Mae, Amherst Pierpont Securities

Using April delinquency rates in VA loans, the forbearance curve also rises and steepens at higher state unemployment rates, although New York does not fit the expected pattern (Exhibit 4). For loans with balances near $100,000, all state delinquency rates fall between 5% and 8%. For loan balances near $300,000, the range expands to between 10% and 15%. However, even though New York has a middle-of-the-range 14.5% April unemployment rate, its forbearance curve is the lowest and flattest. Otherwise, the curve rises and steepens in moving from Virginia with 10.6% unemployment to Illinois with 16.9% unemployment to Michigan with 22.7% unemployment.

Exhibit 4: The April delinquency curve across loan balance in VA also rises and steepens with state unemployment rates, with NY as exception to the rule

Source: Ginnie Mae, Amherst Pierpont Securities

Forbearance appears sensitive to public benefits

The uptake of CARES Act forbearance seems to depend significantly on the ability of borrowers to keep making payments despite clear incentives to take forbearance regardless of ability to pay. Borrowers seem inclined to stay current if possible. Public benefits from outright government transfers, unemployment benefits and other forms of broad economic support seem to reduce forbearance by enhancing ability to pay.

Other things could also explain current forbearance rates. Borrowers may not appreciate how financially attractive it is, despite plenty of press and clear explanations on the websites of most lenders, Fannie Mae, Freddie Mac, the Consumer Financial Protection Bureau and other sources. Applications for forbearance may discourage borrowers, despite their typical simplicity.

To the extent forbearance rates hinge on public benefits, the diminishing impact of the CARES Act $1,200 payment to taxpayers, an end to incremental $600 weekly unemployment benefits on July 31 and the end to PPP loans could reduce public support and raise forbearance rates with significant effects on mortgage prepayment and credit risk.