Uncategorized

Not all forbearance is equal in private MBS

admin | May 29, 2020

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

Delinquency reporting, servicing advancing and potential capitalization of missed payments have all begun to deviate across both legacy and post-crisis private MBS. Most subprime servers are reporting borrowers with forbearance as delinquent, although Ocwen is rolling missed payments into the balance of the loan for some shelves and reporting the loan as current. Many RPL deals also seem to be capitalizing missed payments. These variances have implications for both cash flow and valuation across the different sectors of mortgage credit.

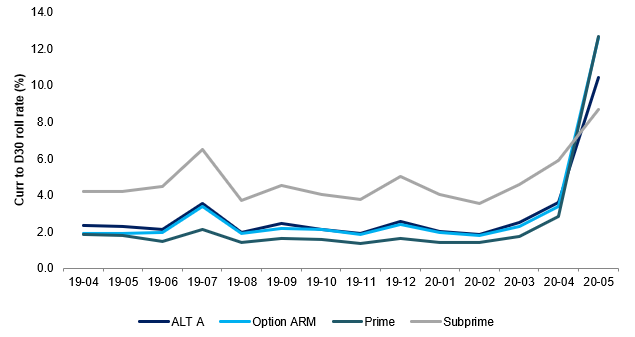

The amount of newly delinquent loans in private MBS began to surge through May remittances, reflecting April borrower activity, as an increasing amount of borrowers started forbearance. Newly delinquent loans rose from the low single digits in April remittances to low double digits in May across prime, Alt-A and Option ARM loans. The delinquency spike in subprime collateral, however, was far more muted in legacy subprime loans, as delinquency rates rose from roughly 6% in April remittances to just over 8.5% in May remittances, prompting a more thorough examination of what may be causing this. (Exhibit 1)

Exhibit 1: Subprime loans appear to have lower delinquency rates

Note: Date shows date of remittance reflecting borrower behavior the month before. Source: Amherst Insight Labs, Amherst Pierpont Securities

Digging in on Ocwen subprime

The more muted spike in delinquencies across subprime loans was primarily a function of Ocwen’s treatment of payment forbearance compared to other private label servicers. It appears that on a portion of the subprime trusts that Ocwen services, missed payments are being capitalized, increasing the principal balance of the borrower’s loan by the amount of any unpaid interest, taxes and insurance. This allows the servicer to continue marking borrowers as current even though they did not make their scheduled monthly payment.

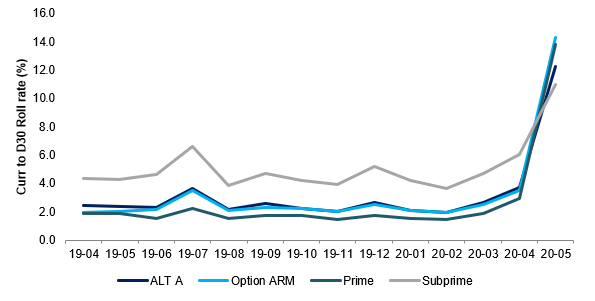

This treatment of loans in forbearance creates two potential issues. First, since the borrower is marked current even though no payment has been made, the servicer is not required to advance any unpaid principal and interest. Depending on the percentage of loans in forbearance in a given trust, deals may experience interest shortfalls or have cash flow shut off entirely. Additionally, this treatment will understate the amount of delinquent borrowers in a given pool. By adding the percentage of loans that received a balance capitalization modification to the loans marked as delinquent, there is a much more pronounced spike in subprime collateral than simply looking at the population of delinquent loans. (Exhibit 2)

Exhibit 2: Delinquencies plus capitalizations give a clearer picture of forbearance

Source: Amherst Insight labs, Amherst Pierpont Securities

It appears Ocwen’s practices may not even be uniform across all legacy trusts. Some Ocwen serviced legacy shelves exhibited neither an increase in delinquency rates nor an increased incidence of capitalization modifications. Observing a population of loans where Ocwen put a borrower into a forbearance plan last month, shows that on certain legacy shelves where Deutsche Bank acts as trustee, these loans did not roll to delinquency or appear to receive a capitalization modification. It seems highly improbable that all these borrowers in forbearance are all current. While it may be possible that the trustee is not reporting the modifications, this also seems improbable as none of these loans saw an increase in their principal balance. This seems to be an issue localized to Ocwen serviced shelves where Deutsche Bank acts as trustee such as ARSI, INDX, LBMLT and RAST to name a few.

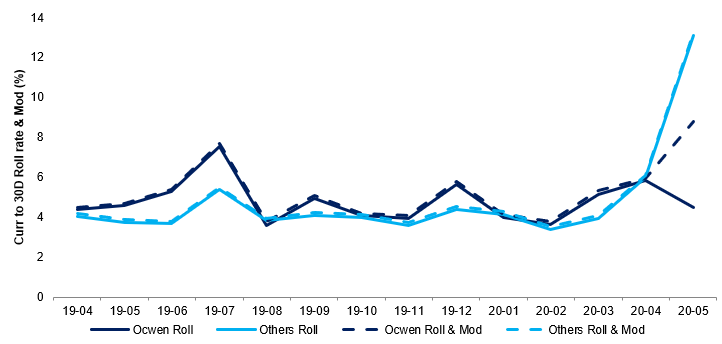

Other subprime servicers seem more uniform

Other subprime servicers seem to be taking a more uniform approach. In conversations with parties to legacy trusts, it appears that other servicers of those trusts will likely extend short-term payment forbearance plans, generally in the range of three month to six months. During this period, borrowers will likely be marked as delinquent. Looking at delinquency plus capitalization modifications for Ocwen compared other servicers shows no material difference between pure roll rates and roll rates plus modifications for other servicers, implying other servicers are reporting loans in forbearance as delinquent similar to treatment of loans in GSE MBS and CRT. Additionally, it seems other servicers will likely follow a GSE-style waterfall at the end of the forbearance period where servicers will try to get borrowers to recoup all missed payments first, then offer a repayment plan before deferring unpaid interest, taxes and insurance on to the maturity of the loan as opposed to Ocwen that is currently capitalizing those payments. (Exhibit 3)

Exhibit 3: Other legacy servicers appear to be reporting loans in forbearance as delinquent

Note: Sample controlled for legacy subprime loans only. Source: Amherst Insight Labs, Amherst Pierpont Securities

Additionally, it seems that servicers will likely make short-term advances on loans in forbearance, likely consistent with the terms of payment forbearance granted. However it is unclear whether servicers will recoup those advances at the end of the forbearance period or leave them in the trust to be recouped at a later date. And while this does not completely take all potential cash flow uncertainty and risk off the table, there may be greater certainty and transparency on deals serviced by other servers than those serviced by Ocwen.

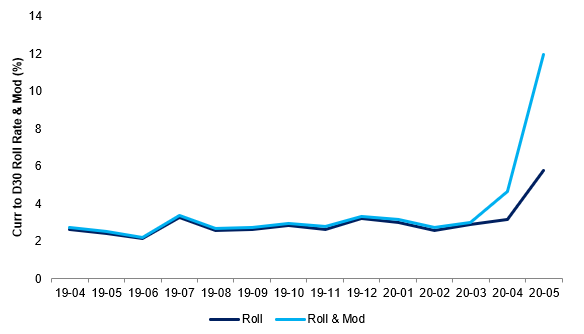

Capitalization of missed payments also happening in RPLs

With the caveat that May remittance data is still being reported for seasoned RPL transactions, it appears capitalization modifications are occurring on potentially COVID-19 impacted borrowers in seasoned RPL trusts. Looking at absolute roll rates relative to roll plus modification rates shows a significant incidence of capitalization modifications. This is likely driven by the fact that servicers of RPL trusts are generally only required to make advances towards lien and property preservation by paying a delinquent borrower’s taxes and insurance. Servicers are generally not required to advance principal and interest. As such, it seems likely that capitalization modifications may become fairly prevalent in RPL deals. After layering in capitalization modifications, loans potentially in payment forbearance doubles from just under 6% to 12%, roughly in line with other legacy collateral. (Exhibit 4)

Exhibit 4: Capitalization modifications happening in seasoned RPLs

Source: Amherst Insight Labs, Amherst Pierpont Securities

Given the lack of principal and interest advancing in RPL trusts, cash flow uncertainty is less of an issue than in legacy RMBS to the extent that interest shortfalls are going to hit the trust on loans that are either delinquent or in forbearance, potentially making seasoned RPLs a more straightforward asset class to analyze than legacy RMBS. But it still presents the issue of the potential understatement of loans in payment forbearance as servicers continue to capitalize missed payments and report the borrower as current.