Uncategorized

Love it or flip it

admin | April 24, 2020

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

Given the one sided nature of trading over the past four weeks, most new investment grade Bank/Financial deals that have priced have performed favorably since their debuts. However, as spread tightening has curbed over the past week, some of these deals—particularly those that have been heavily oversubscribed—deserve a closer look to determine if they hold good longer-term valuation or are candidates for short-term gains while trading tighter on the follow. Two of the more recent interesting launches in Bank/Financial illustrate where investors should seek to add more (love it) or consider taking their short-term gains and put money to work elsewhere (flip it).

The investment grade new issue market has remained in overdrive since the government first introduced the Fed corporate credit facilities on March 22, 2020. Over the last four weeks, 173 issuers have brought over $355 billion in new corporate debt; more than triple the amount issued over the same period last spring. The washout in global oil prices and related spread widening that kicked off start of the week led to one of the worst Mondays in IG new issue in weeks. The first session saw significant resistance from lenders, and included a cancelled deal (Nationwide Mutual (NATMUT: A3/A- 40-yr surplus notes) as investors balked at what was perceived as aggressive pricing. Since then primary markets have re-gained steam, demonstrating less reluctance from syndicates and investors than what was seen over the first two sessions of the week.

Love it: First Horizon National (FHN: Baa3/BBB-) brings a rare 10-year regional subordinated bank note yielding 5.75% (~515/10-year).

Domestic Banks have been among the better performing segments since the start of the credit sell-off beginning the third week in February. Despite negative implications for the operating environment (lower margins, higher credit provisions), IG US banks are largely well capitalized and well positioned for the likely economic downturn resulting from COVID-19, relative to other sectors in the IG landscape.

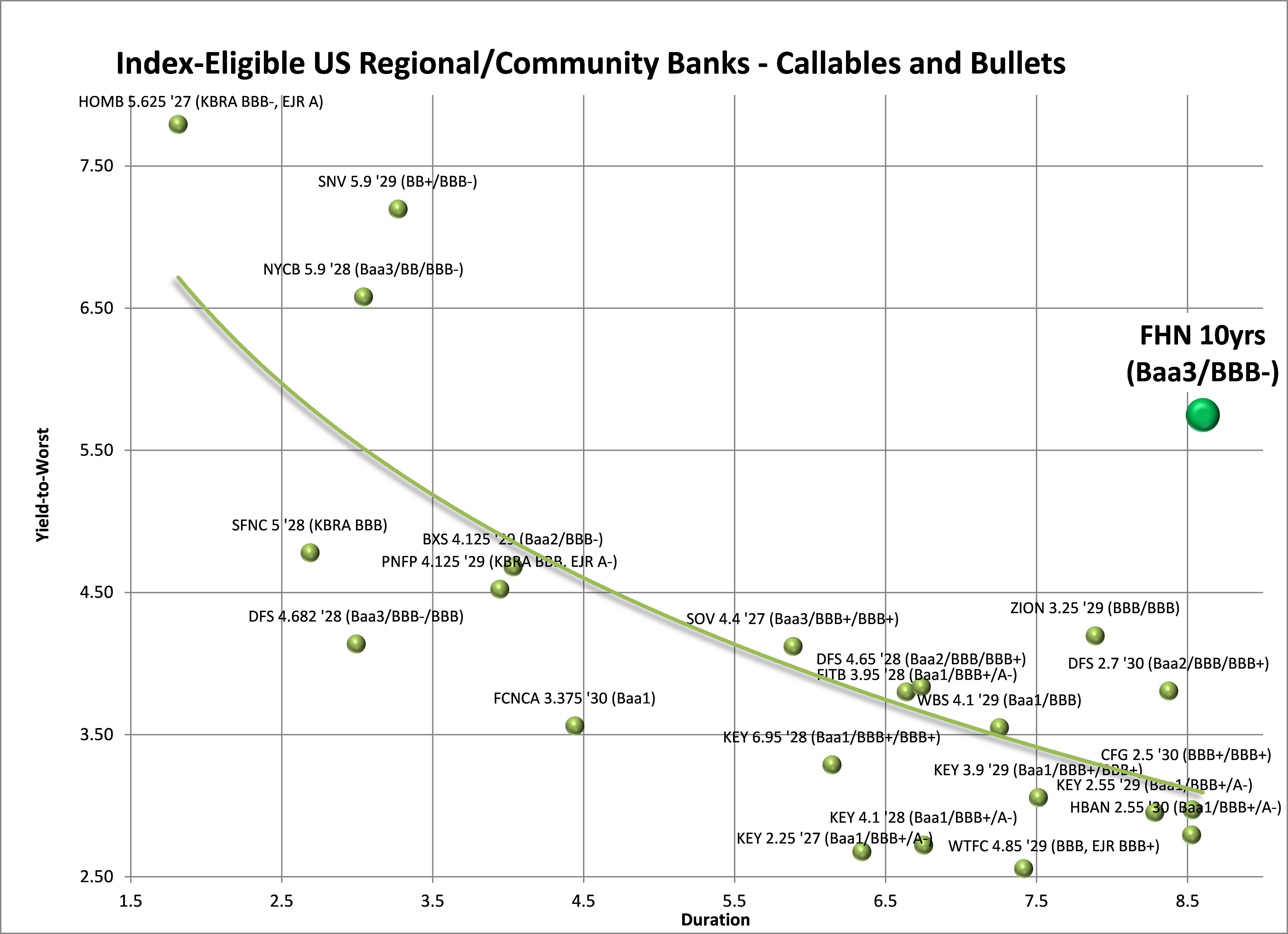

FHN is an infrequent issuer in the space, and will likely use a large portion of the $450 million proceeds to term out its last remaining public debt outstanding ($500 million), which matures near year-end. Most banks of this size/stature with funding needs have been utilizing non-Index private placement debt issues, mostly which include a callable (10NC5) structure. There are only a few instances of banks in the $20-100 billion total asset range issuing IG index eligible bullet structures comparable to the notes that FHN launched this week. Given that rarity, the bonds are attractively priced on a yield basis, particularly when looking at non-Index comps, many of which do not have two IG ratings. Bonds are even more attractively priced when looking at the few Index eligible regional bank notes in that part of the curve that are available for comparison (Exhibit 1).

Exhibit 1: Comparison of some regional and community bank paper

Source: Amherst Pierpont Securities, Bloomberg/TRACE – Yield-to-Worst Indications

FHN is a TN-based regional lender with $43 billion in total assets and $32 billion in total deposits. The bank is currently engaged in a recently announced merger with IberiaBank (IBKC), which is scheduled to close mid-year will add an additional $32 billion in assets and $24 billion in total deposits. FHN has 271 branches and a Southern footprint, which includes TN, GA, MS, TX, and Carolinas. The IBKC deal will expand into LA, AR and TN. The Bank has a somewhat diversified loan mix, which is skewed to commercial categories including C&I (26%) and CRE (21.5%). FHN also operates a mid-sized broker-dealer, providing diversified cash flows in periods of lower rates / weaker net interest margins. The current Tier 1 CET Capital ratio is adequate at 9.2%, with a total capital ratio of 11.2%, but should likely be a priority for management going forward. There were no material credit concerns as of year-end with a non-performing asset (NPA) ratio of 0.78% of total assets, and a Texas Ratio (NPA+90D past due loans / tangible equity + loan loss reserves) of only 11% (we consider scores under 20% adequate for most IG banks). The addition of IBKC will increase energy exposure, given its Gulf state footprint. FHN’s funding profile appears stable with Loan/Deposit under <100% and reliance on wholesale funding <20%.

Flip it: NASDAQ (NDAQ: Baa2/BBB) moves out the curve with a first time 30-year note that priced (+215) well inside of initial talk (+300), raising questions about longer-term event risk in the industry.

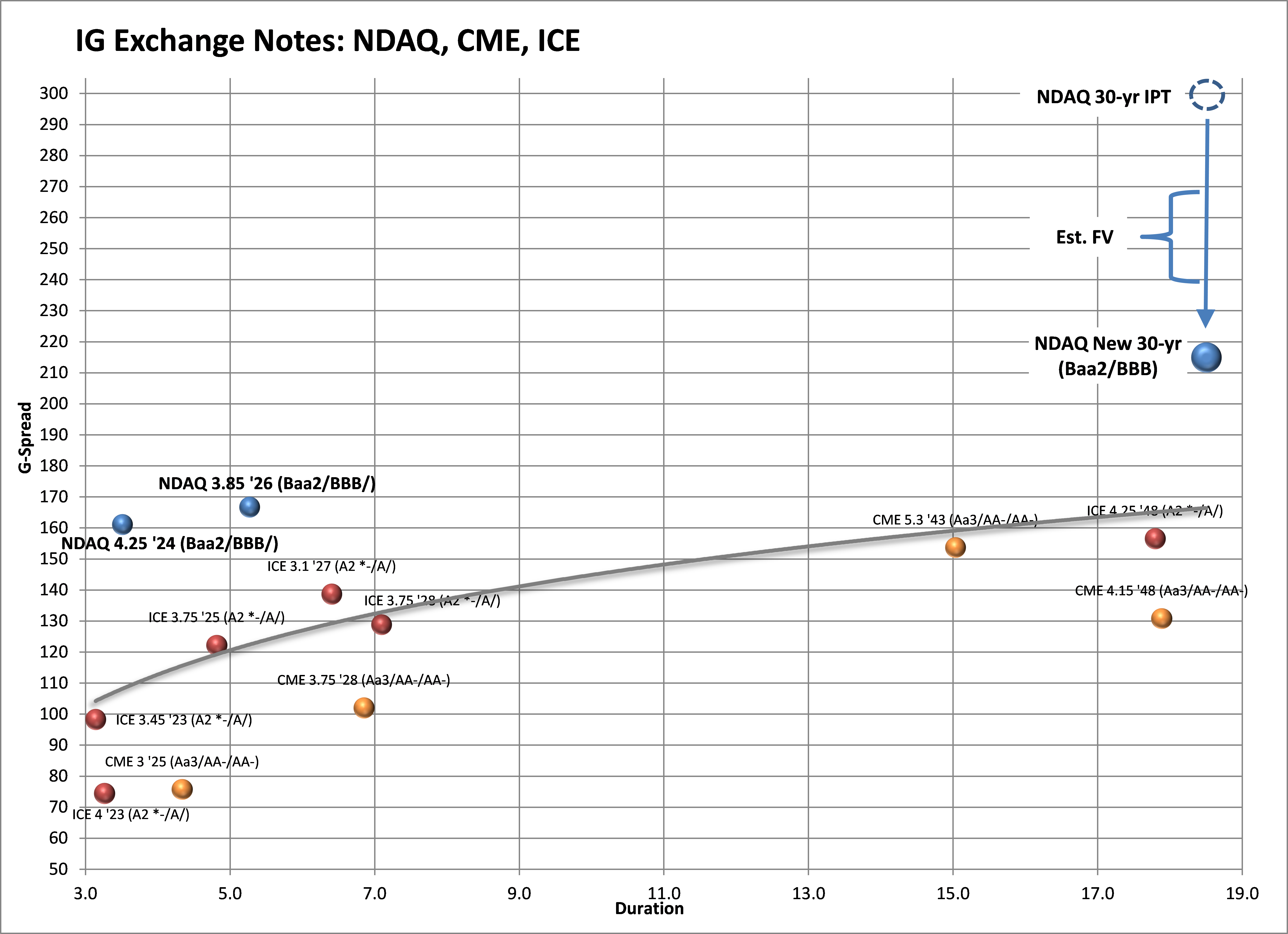

NDAQ’s 30-year launch came 85 bp tight to IPT and roughly 25 to 50 bp tight of anticipated fair value based on peer comparables and the steepness of similar credit/sector curves. The deal was highly oversubscribed, which was reflected in the eventual launch level. Exchanges have performed extremely well in the credit sell-off of the past two months; not surprising given their strategically well-positioned operating models and consistent cash flows. Exchanges also provide a more defensive segment within the broader Broker-Asset Manager sector within most major IG indices, making the launch particularly attractive to Index investors.

Exhibit 2: Relative value in Exchange notes

Source: Amherst Pierpont Securities, Bloomberg/TRACE – G-spread Indications

Nevertheless, given the higher degree of leverage at NDAQ versus peers CME and ICE, and the continuing threat of consolidation / event risk within the industry, investors should be reluctant to add exposure to the new 30-year notes at current valuation. The recent, and highly surprising, move by ICE to attempt to merge with EBAY helped demonstrate that despite a multi-year period of consolidation within the industry, the risk of debt-funded M&A activity remains prevalent within the industry, and could perhaps could be entering a less predictable phase. NDAQ has a strong liquidity position with no maturities until 2023 and a $1 billion revolver through 2022. The 30-year debt launch will be used to term out some of its existing debt, so presumably there could be a tender offer in the near-term. Still, overall net leverage remains high for the segment at nearly 2.5x at year-end versus 2.15x for ICE and less than 1x at CME. A steeper curve was expected to compensate investors, particularly if NDAQ is positioning the balance sheet for future M&A or if the company were to get drawn into a bidding war for the next attractive strategic target in the industry.