Uncategorized

Adopt defensive posture emphasizing domestic banks and technology

admin | March 20, 2020

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

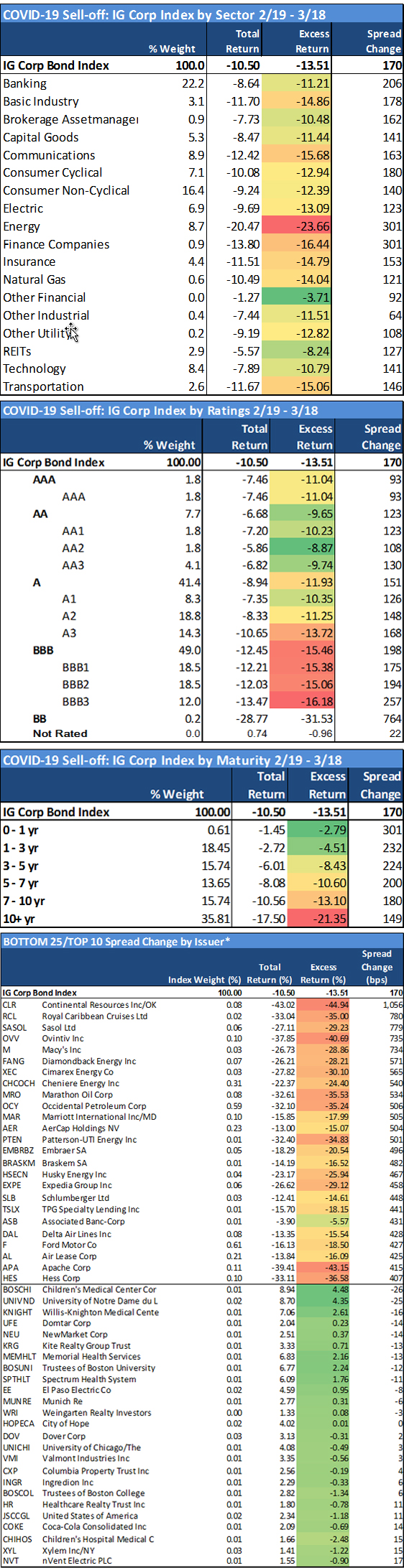

Investors should move to a more defensive posture based on expectations that the global economic fallout of the COVID-19 outbreak will continue well into the second half of 2020, with limited prospect for relief in near-term volatility. The compounded stress on energy/commodity markets is making it extremely difficult to time fluctuations in valuation among commodity credits, which further supports a call to overweight more defensive segments within the Index. The long-term valuation proposition in higher rated, less cyclical credits is compelling enough to forego more aggressive strategies that are susceptible to day-to-day swings in volatility.

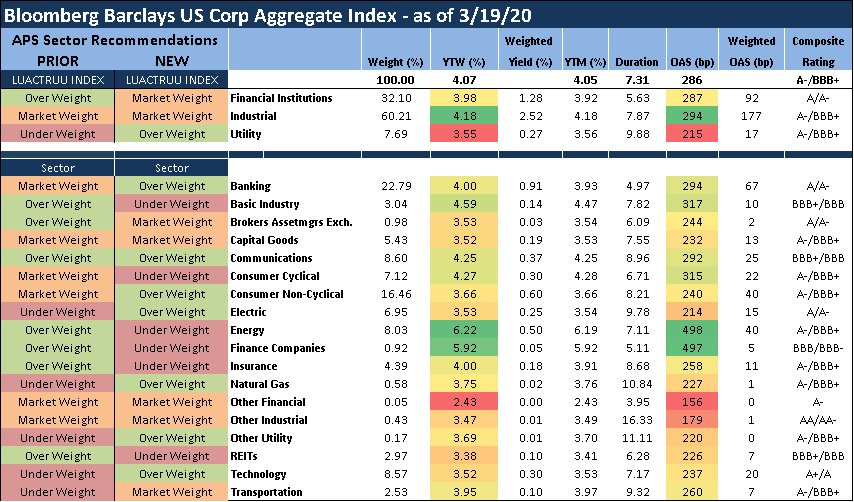

Exhibit 1: Updated sector recommendations

Note: Updated sector recommendations within the IG Index are based on performance expectations over the next several months on an Excess Return basis (total return net of commensurate UST return). These weightings serve as a proxy for how portfolio managers should position their holdings relative to the broad IG corporate bond market. Source: Bloomberg/Barclays US corporate index, Amherst Pierpont Securities

Key Sector View Changes

Banking – Overweight from Marketweight: Over the past few days, three of the US money center banks brought long duration new issues (JPM $2.5 billion 11NC10s, MS $2 billion 31NC30s, C $1.3 billion 21NC20s), with large concessions to investors but attractive overall yields to the issuers. Investors should be positioning these new issues aggressively at these current valuations. While the macro and yield curve environment present obvious challenges and obstacles to near-term profitability, bank balance sheets remain extremely well capitalized with added flexibility available (throughout postponement of shareholder payouts). The banks are being utilized in Fed policy as a source and backstop to systemic liquidity, and are at present reportedly being told to keep “dry powder” – a favorable posture for bondholders. Investors should favor US money center banks over the regionals, while there is good long-term valuation in the otherwise conservative, smaller regional and community banks with debt outstanding.

Consumer Cyclical – Underweight from Marketweight: The sector is suffering heavy negative impact from COVID-19 as retailers close stores and restaurants primarily move to to-go orders. While expectations are for an increase in online sales for retailers, the consumer will be focusing mostly on non-discretionary purchases. Large restaurant chains are currently forecasting same store restaurant sales to be down 50% in the current quarter, which arguably will put them into free cash flow negative territory. Lodging is seeing occupancy rates across North America and Europe below 25%, forcing hotels to shut down and workers to be furloughed in an effort to stem the cash drain.

Consumer Non-Cyclical – Overweight from Marketweight: Packed Food and Grocers are benefiting from pantry stocking which will likely be somewhat short lived. Panic buying of shelf stable items will take the consumer some time to consume, that said the initial volume burst will taper off a bit. This could change buying patterns of the consumer though for an extended period of time as a larger portion of the global population will need to look at home prepared meals as a way to offset lost income.

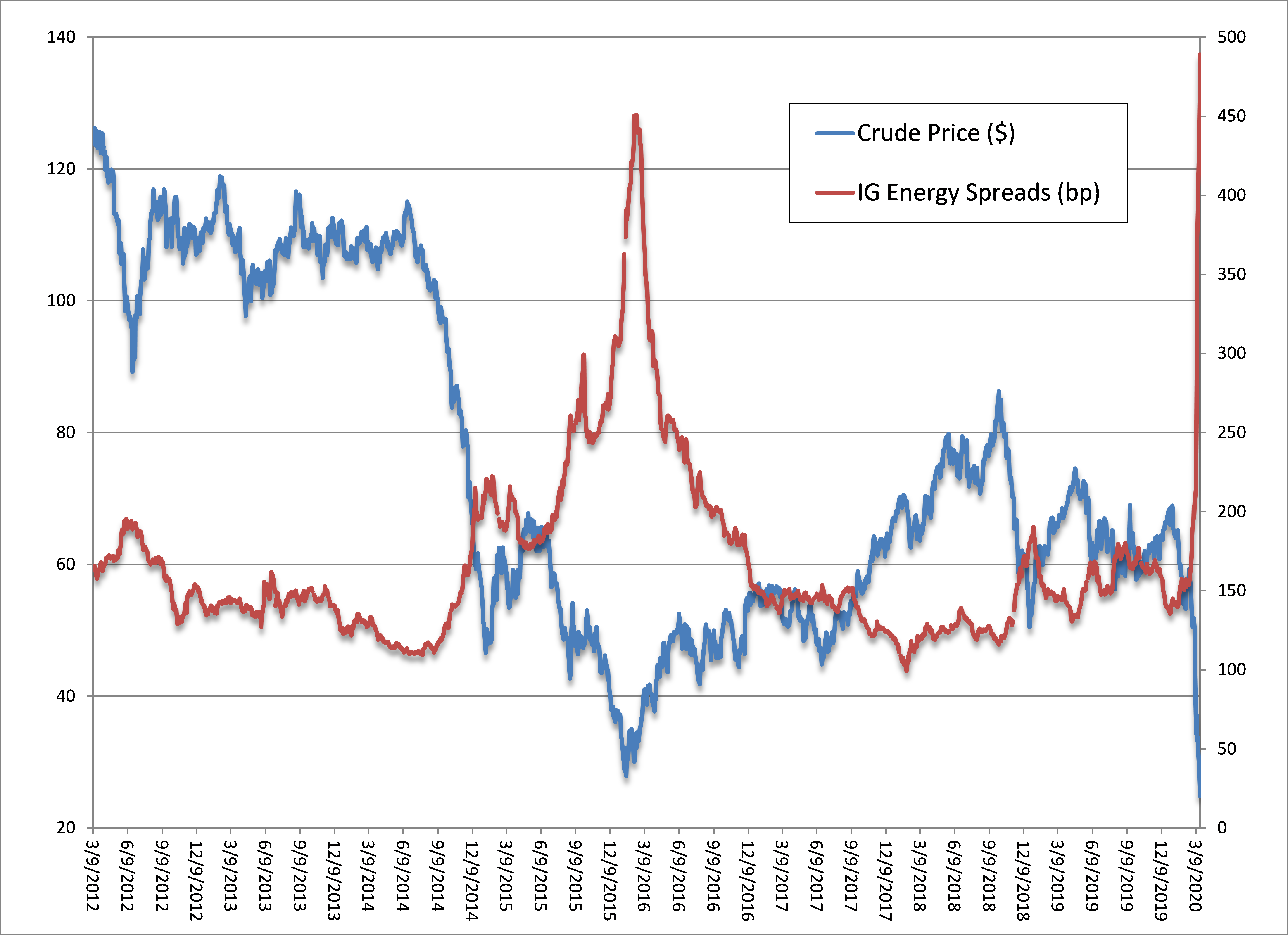

Exhibit 2: IG Energy spreads vs. crude prices

Note: Bloomberg/Barclays Corporate Agg Index, Bloomberg Generic 1st CO Futures Contract. Source: Bloomberg, Amherst Pierpont Securities

Insurance – Underweight from Overweight: The Insurance industry—in particular the Life insurers—are facing challenges on numerous fronts in the current market environment. The flat yield curve, low re-investment yields, annuity exposure, and volatile investment returns are among the more obvious issues surrounding the sell-off in the industry. Investors should maintain less exposure to Insurance overall, while concentrating holdings in the highest quality issuers that have sold off with the broader segment (ALL, PGR, BRK, CB).

REITs – Underweight from Overweight: With retailers implementing store closures and office employers following telecommuting protocols for coronavirus, there are significant concerns that this temporary period of displacement will have more permanent impacts on both Retail and Office REIT commercial real estate. Retailers are likely to make store closures permanent, accelerating the pre-existing meltdown in traditional commercial real estate for mall operators. Recommend investors shift weightings within the sector to the Industrial, Health Care, Cell Tower and well-diversified Single-Tenant (triple-net) segments.

Technology – Overweight from Underweight: Liquidity is king and the cash rich balance sheets of the large cap technology/Internet credits, with some boasting large net cash positions, are providing a relative safe haven during these volatile times. The space further benefits from high free cash flow conversion rates, which helps to boost liquidity.

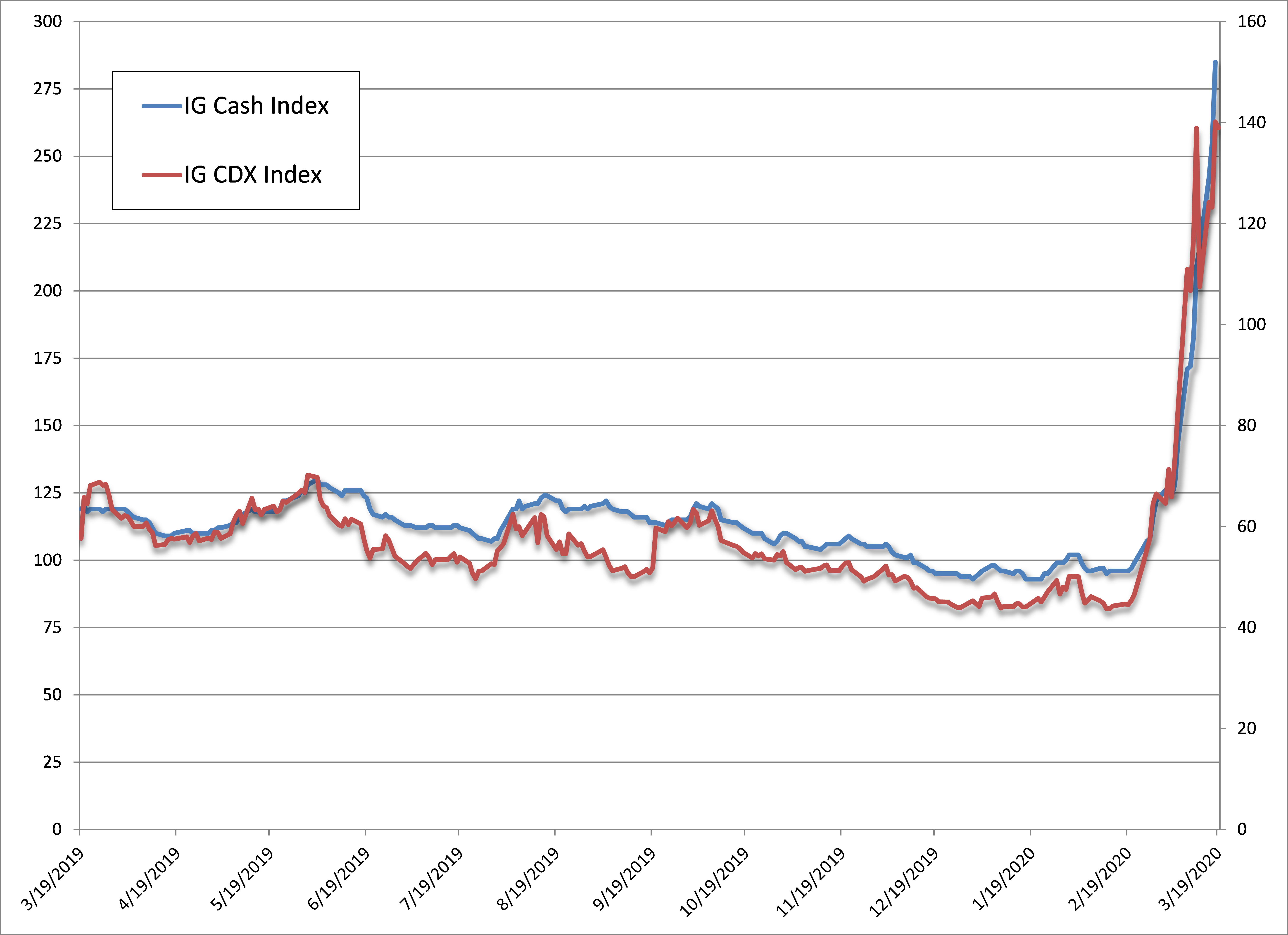

Exhibit 3: Corporate bond spreads (cash and CDS)

Source: Bloomberg/Barclays Corp Agg Index, Markit CDX NAIG Index, Amherst Pierpont Securities

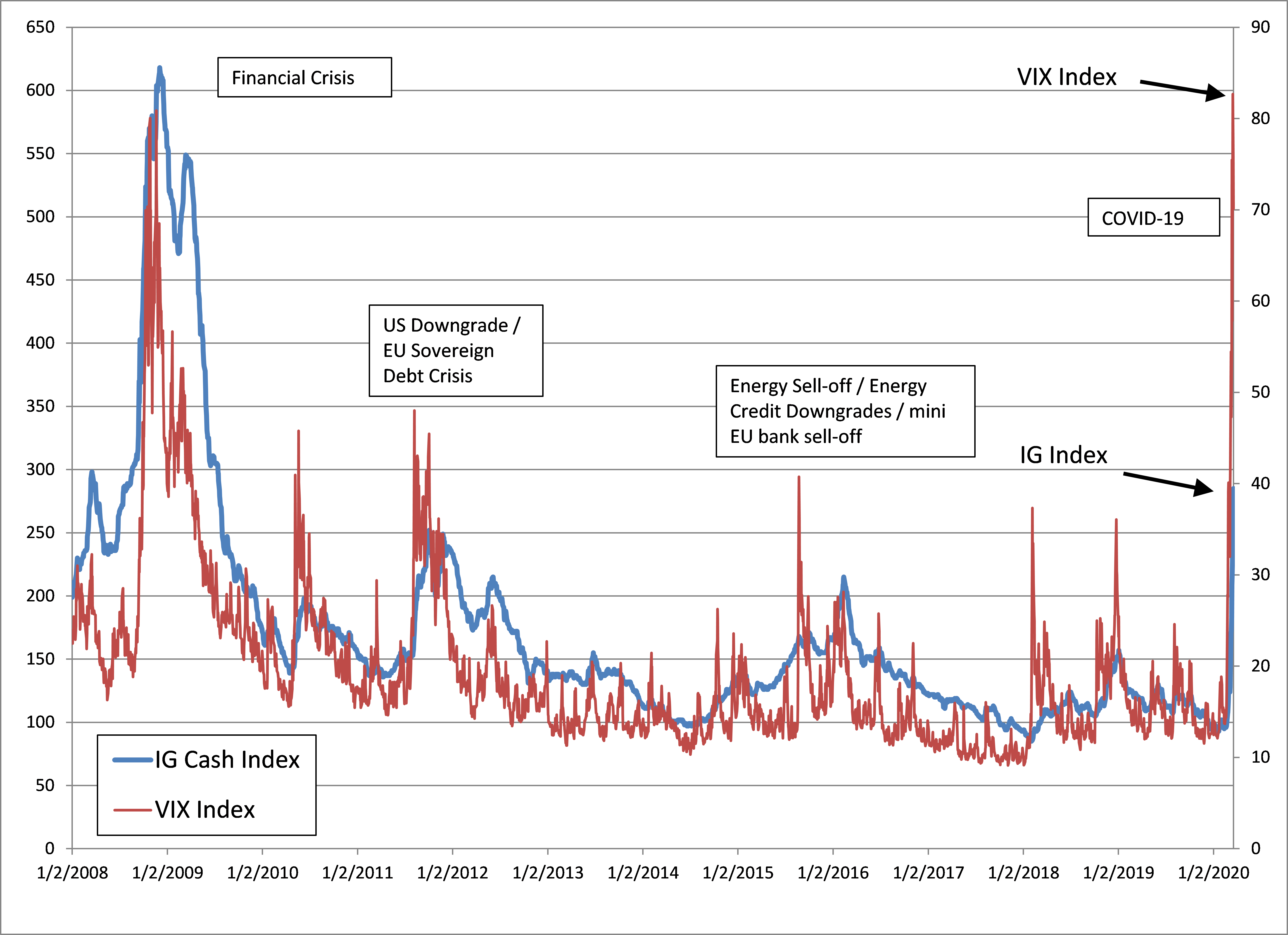

Exhibit 4: Corporate Bond Spreads vs VIX Index (historic)

Source: Bloomberg/Barclays Corp Agg Index, CBOE Volatility Index, Amherst Pierpont Securities

Source: Bloomberg/Barclays Agg Index, Amherst Pierpont Securities