Uncategorized

Prepayments turn lower, New York stays slow

admin | December 6, 2019

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

A large drop in day count, slower seasonal turnover and slightly higher trailing interest rates drove conventional MBS prepayment speeds down an expected 21% in November. Unless interest rates drop sharply, October’s levels should mark the peak of prepayments for the foreseeable future.

Even slower speeds ahead

Prepayment speeds should continue to slow over the next few months. Interest rates have increased further and turnover should continue its seasonal slowdown. December’s print should be relative similar to November’s, since there is a slight pick-up in day count that offsets further seasonal slowdowns and slightly higher lagged interest rates. Speeds should bottom out in January and February, likely roughly 10% below November’s levels.

Fast servicers prepaid slower in New York in November

New York loans typically prepay much slower than loans from other states due to significantly higher closing costs. Borrowers generally pay higher legal fees and must pay a mortgage recording tax, which can exceed 2% of the loan balance in some locations. The disincentive is strong enough that even pools issued by very fast servicers prepay slower than a typical TBA pool from outside of New York.

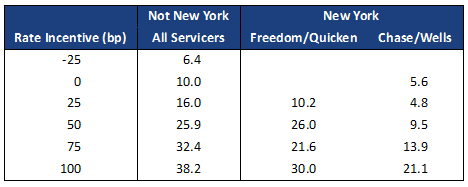

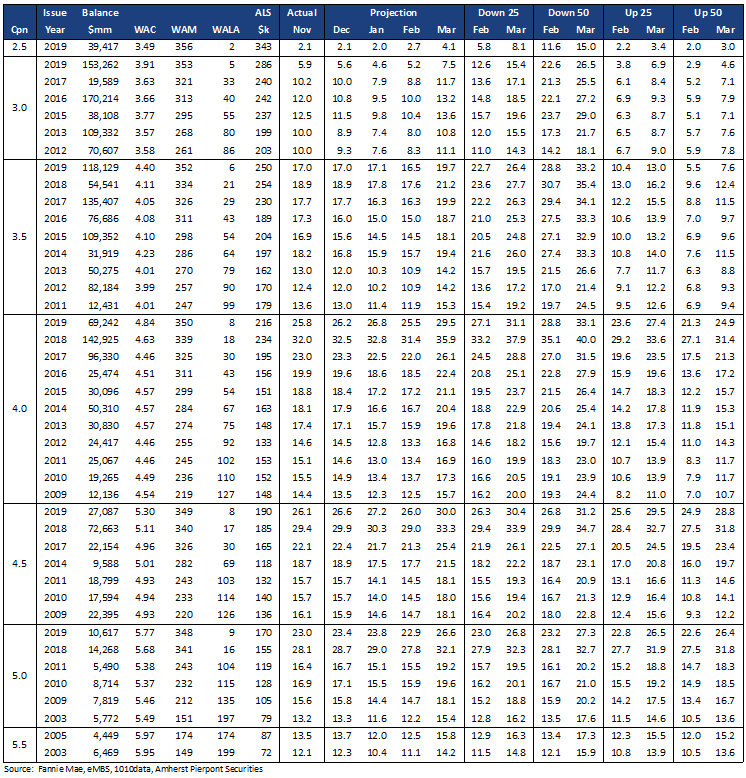

The speed advantage in New York pools—even from fast servicers—persisted in November (Exhibit 1). The average loan from outside of New York prepaid faster than even Freedom/Quicken New York loans everywhere except the 50 bp refinance incentive bucket, where New York’s Freedom/Quicken loans matched the others. Even when the loans are 100 bp in-the-money, the fast servicers prepaid roughly 20% slower than generic loans. Pay-ups tend to be much lower for the faster servicers, which can make these loans an inexpensive source of prepayment protection.

Exhibit 1: Fast servicers in NY prepaid slower than TBA in November

Note: The exhibit shows the November S-Curves for loans in TBA-deliverable pools of at least $200,000 in loan size. All of the loans have WALAs between 6 and 24 months, which is typically when the S-Curve is the steepest (6 to 12 wala might be even steeper but there aren’t enough loans to do this cut). The first column includes all loans from outside New York. Source: Yield Book, Amherst Pierpont Securities

The Fannie Mae and Freddie Mac numbers

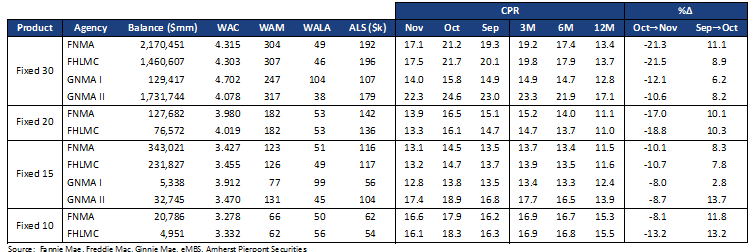

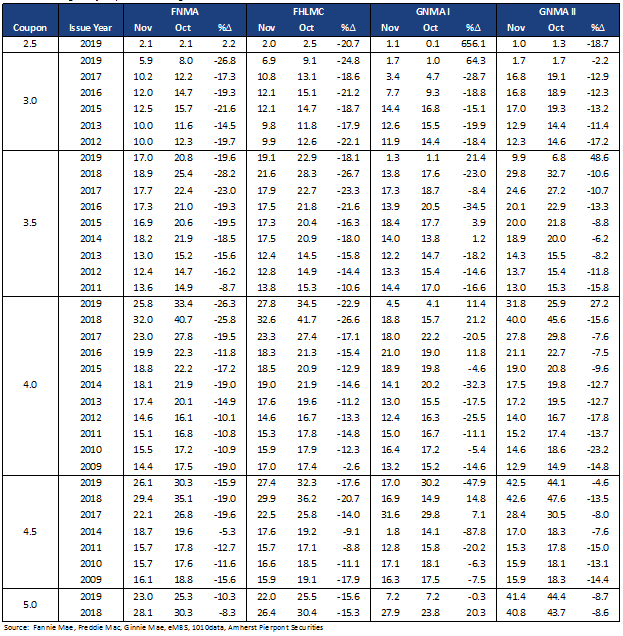

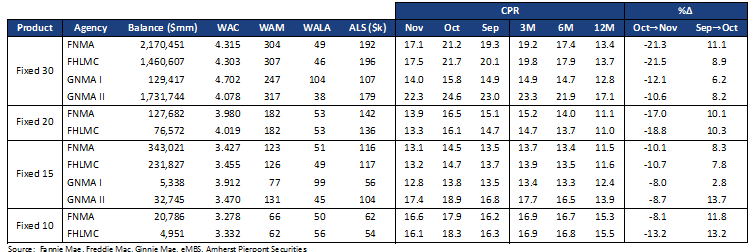

Both Fannie Mae and Freddie Mac 30-year MBS slowed 21% in November and dropped similarly across the coupon stack. The sharpest declines came in more recent production 3.0%s, 3.5%s, and 4.0%s. These increased the most during the refi wave so it is natural they would slow the most. For example, 2018 3.5%s slowed 28.2% to 18.9 CPR from 25.4 CPR.

Ginnie Mae speeds slowed less than conventionals

Overall Ginnie Mae II MBS slowed only 11%, much less of a drop than conventionals. However many government loans are reaching 6 and 7 wala and have a difficult time refinancing before then. Both the FHA and VA have very strict controls that discourage refinancing prior to 6 WALA (FHA) and 7 WALA (VA). The MBA’s government refinance index has been signaling that Ginnie Mae speeds would remain stronger than conventional speeds. An 11% drop is below the 13.5% drop implied by only day count.

Data Tables

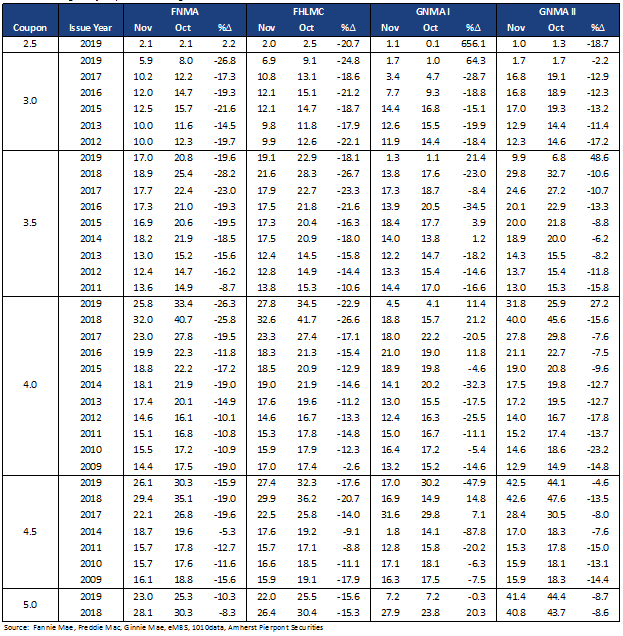

Exhibit 2: Prepayment Summary

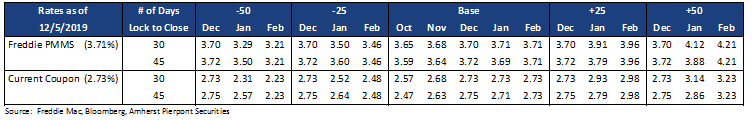

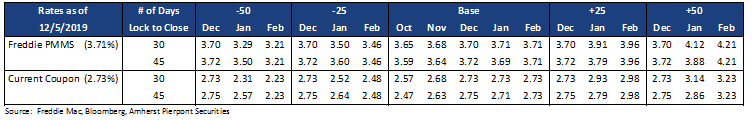

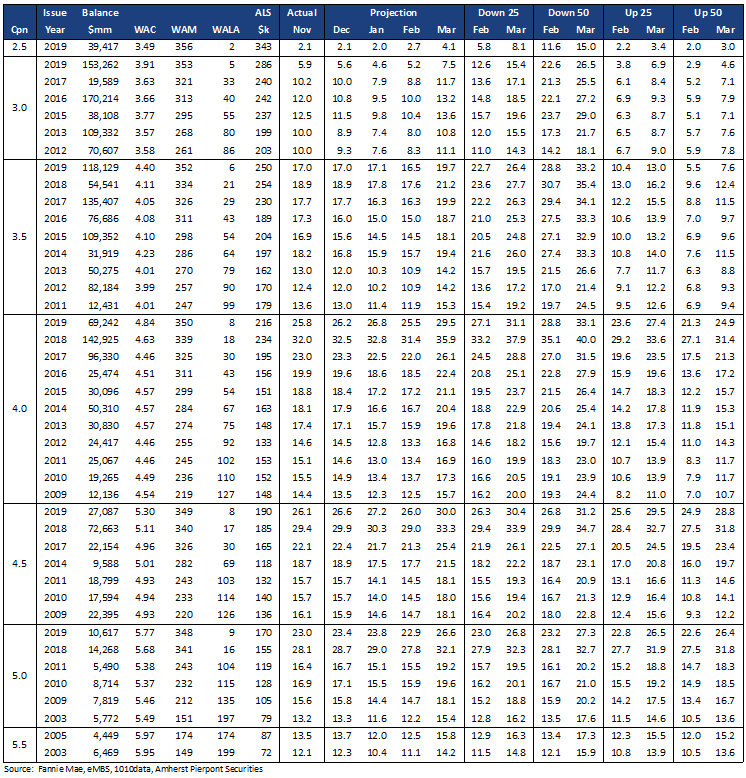

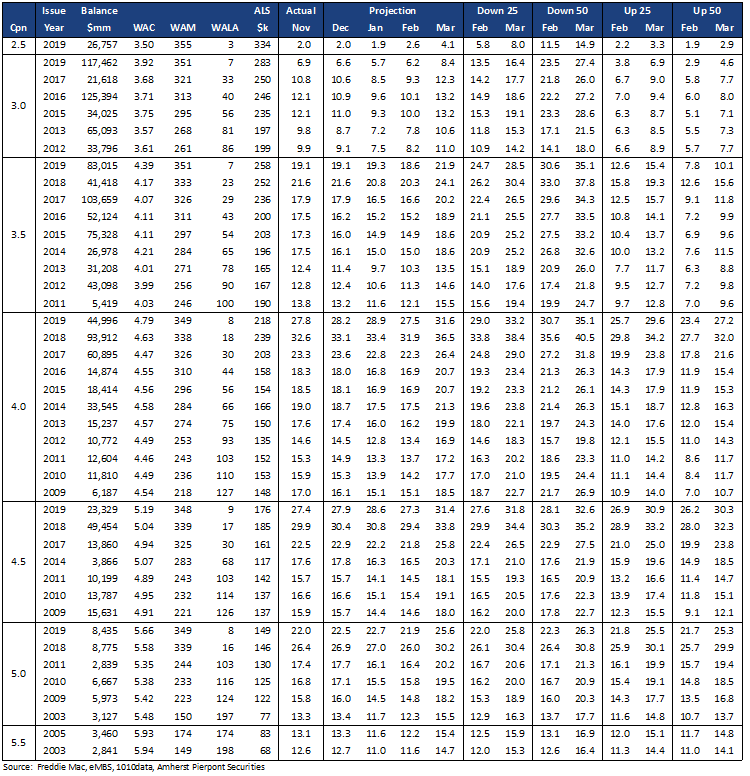

Our short term forecast is shown in Exhibit 5 (Fannie Mae) and Exhibit 6 (Freddie Mac). Exhibit 4 shows the static rates used in the prepayment forecast.

Exhibit 3: Agency Speeds, Largest Cohorts

Exhibit 4: Mortgage Rate Forecast

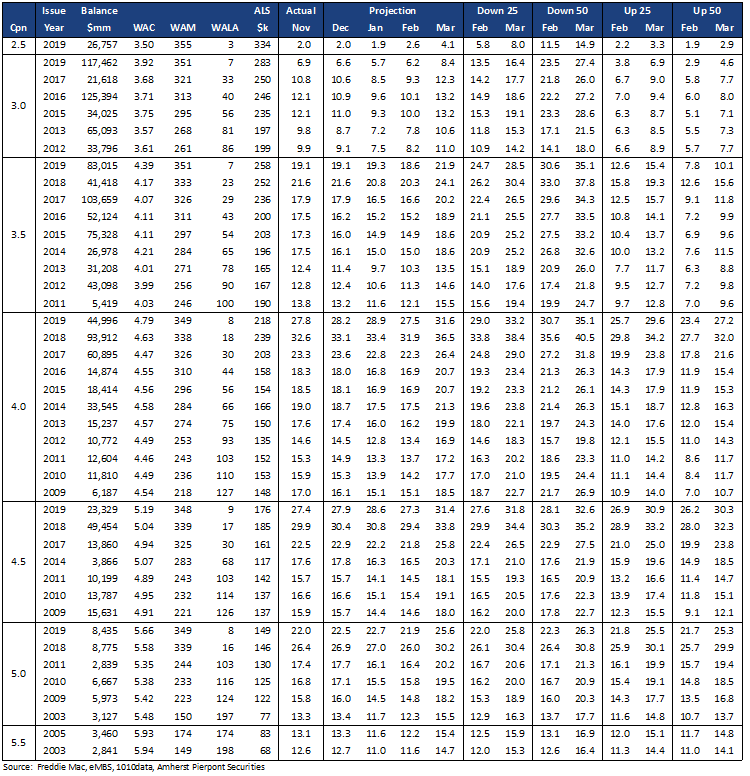

Exhibit 5: Fannie Mae Short Term Forecast

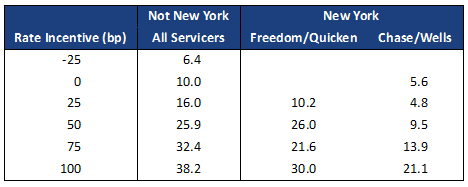

Exhibit 6: Freddie Mac Short Term Forecast

This material is intended only for institutional investors and does not carry all of the independence and disclosure standards of retail debt research reports. In the preparation of this material, the author may have consulted or otherwise discussed the matters referenced herein with one or more of SCM’s trading desks, any of which may have accumulated or otherwise taken a position, long or short, in any of the financial instruments discussed in or related to this material. Further, SCM may act as a market maker or principal dealer and may have proprietary interests that differ or conflict with the recipient hereof, in connection with any financial instrument discussed in or related to this material.

This message, including any attachments or links contained herein, is subject to important disclaimers, conditions, and disclosures regarding Electronic Communications, which you can find at https://portfolio-strategy.apsec.com/sancap-disclaimers-and-disclosures.

Important Disclaimers

Copyright © 2024 Santander US Capital Markets LLC and its affiliates (“SCM”). All rights reserved. SCM is a member of FINRA and SIPC. This material is intended for limited distribution to institutions only and is not publicly available. Any unauthorized use or disclosure is prohibited.

In making this material available, SCM (i) is not providing any advice to the recipient, including, without limitation, any advice as to investment, legal, accounting, tax and financial matters, (ii) is not acting as an advisor or fiduciary in respect of the recipient, (iii) is not making any predictions or projections and (iv) intends that any recipient to which SCM has provided this material is an “institutional investor” (as defined under applicable law and regulation, including FINRA Rule 4512 and that this material will not be disseminated, in whole or part, to any third party by the recipient.

The author of this material is an economist, desk strategist or trader. In the preparation of this material, the author may have consulted or otherwise discussed the matters referenced herein with one or more of SCM’s trading desks, any of which may have accumulated or otherwise taken a position, long or short, in any of the financial instruments discussed in or related to this material. Further, SCM or any of its affiliates may act as a market maker or principal dealer and may have proprietary interests that differ or conflict with the recipient hereof, in connection with any financial instrument discussed in or related to this material.

This material (i) has been prepared for information purposes only and does not constitute a solicitation or an offer to buy or sell any securities, related investments or other financial instruments, (ii) is neither research, a “research report” as commonly understood under the securities laws and regulations promulgated thereunder nor the product of a research department, (iii) or parts thereof may have been obtained from various sources, the reliability of which has not been verified and cannot be guaranteed by SCM, (iv) should not be reproduced or disclosed to any other person, without SCM’s prior consent and (v) is not intended for distribution in any jurisdiction in which its distribution would be prohibited.

In connection with this material, SCM (i) makes no representation or warranties as to the appropriateness or reliance for use in any transaction or as to the permissibility or legality of any financial instrument in any jurisdiction, (ii) believes the information in this material to be reliable, has not independently verified such information and makes no representation, express or implied, with regard to the accuracy or completeness of such information, (iii) accepts no responsibility or liability as to any reliance placed, or investment decision made, on the basis of such information by the recipient and (iv) does not undertake, and disclaims any duty to undertake, to update or to revise the information contained in this material.

Unless otherwise stated, the views, opinions, forecasts, valuations, or estimates contained in this material are those solely of the author, as of the date of publication of this material, and are subject to change without notice. The recipient of this material should make an independent evaluation of this information and make such other investigations as the recipient considers necessary (including obtaining independent financial advice), before transacting in any financial market or instrument discussed in or related to this material.