Uncategorized

FHFA’s dramatic solution to a modest problem

admin | November 15, 2019

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

The recent FHFA proposal to change the Fannie Mae and Freddie Mac pooling process would require the enterprises to dictate exactly which loans could be placed in single-issuer pools. This would likely have a dramatic and detrimental effect on investors and originators of conventional MBS. However, only a small portion of generic single-issuer pools prepay worse than the large monthly 30-year multiple-issuer pools, and it is unlikely that these single-issuer pools could have a large effect on TBA pricing. Such a major change to pooling does not seem warranted.

Who issues generic single-issuer pools?

Most single-issuer pools contain loans with better prepayment characteristics such as low loan balance. These pools command a pay-up over the TBA price, and originators can only capture that pay-up by creating their own pools. But a generic single-issuer pool that doesn’t appear to have beneficial loan characteristics often commands a premium as well, since that lender’s loans likely have proven to prepay better than average.

A lender with poor prepayment performance won’t be able to command a pay-up for their loans and therefore will usually place loans into a multiple-issuer pool. However, the GSEs can limit how many loans some lenders can place into multiple-issuer pools, forcing them to create single-issuer pools that may have worse convexity that the multiple-issuer pools.

The majority of generic single-issuer pools are created by slower-than-average servicers (Exhibit 1). Freddie Mac in particular issues very few single-issuer pools by faster servicers, likely the result of efforts to improve prepayment performance leading into UMBS. Freddie Mac and the FHFA had been told for years that one reason the Gold TBA traded behind Fannie Mae was that the risk of being delivered an especially poor prepaying pool was greater with the Gold TBA. So Freddie Mac took steps to encourage originators to use the multiple-issuer pooling programs.

Exhibit 1: Single-issuer pools are predominantly issued by slower servicers

Fast/slow servicer is determined using Amherst Pierpont’s servicer prepayment ranking report as of October 2019. Issuance ranges from November 2018 through May 2019 (pre-UMBS) and June 2019 through October 2019 (UMBS). Source: Fannie Mae, Freddie Mac, eMBS, Amherst Pierpont Securities

Slower servicers are, on average roughly 5% slower than the average servicer. The faster servicers are roughly 6% faster than average post-UMBS, but were 15.1% faster pre-UMBS. A major driver of this change is Quicken, which has issued far fewer generic pools after the introduction of UMBS.

Multiple-issuer pool production is far larger than generic single-issuer production

The majority of generic loans are already placed into multiple-issuer pools (Exhibit 2). In the UMBS-era, 76.0% of generic production has been placed in multiple-issuer pools. Another 21.4% of production has been placed in single-issuer pools from slow servicers, leaving only 2.6% of generic pools created by fast servicers.

Exhibit 2: 75% of generic pool production is in multiple-issuer pools

See Exhibit 1 for a description of the pool population. Source: Fannie Mae, Freddie Mac, eMBS, Amherst Pierpont Securities

Single-issuer generic pools outperformed multiple-issuer pools during the summer refi wave

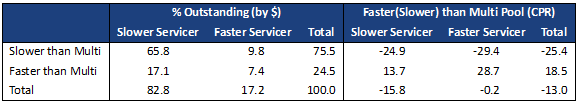

Prepayment speeds on 6-to-12 WALA single-issuer generic pools prepaid 13.0 CPR slower on average than the same-coupon multiple-issuer pools from July through October 2019, the height of the refinance wave (Exhibit 3). The first section in the table breaks the distribution of pools into those issued by faster and slower servicers, and each row segments the pools that prepaid faster and slower than the multiple-issuer pools. The second section calculates the CPR difference, faster or slower, than the corresponding coupon’s multiple-issuer pools.

Exhibit 3: Single-issuer pools prepaid slower than multi pools from July through October 2019

Source: Fannie Mae, Freddie Mac, eMBS, Amherst Pierpont Securities

The majority of these pools (65.8%) were issued by slower servicers and prepaid 24.9 CPR slower than the multiple-issuer pool. Another 9.8% of pools were issued by faster servicers yet prepaid 29.4 CPR slower than the multiple-issuer pool. Overall 75.5% of single-issuer pools prepaid slower than multiple-issuer pools, by an average of 25.4 CPR.

The remaining 24.5% of single-issuer pools prepaid faster than the multiple-issuer pools, by an average 18.5 CPR. Within this population the pools issued by faster servicers prepaid significantly worse than those issued by slower servicers.

Overall the single-issuer pool population prepaid 13.0 CPR slower than the multiple-issuer pools. The disparity between the size of the multiple-issuer pools and the small amount of poor-performing single-issuer pools makes it very unlikely that TBA pricing is influenced by single-issuer pools.

Altering pooling practices would hurt servicers with better prepaying loans

The FHFA’s proposal would introduce sweeping changes to how loans are pooled and likely force most generic loan production from better prepaying lenders into the multiple-issuer pool. Market pricing already makes it more difficult for poor performing servicers to create their own pools, and these lenders generally deliver their loans into multiple-issuer pools. The prepayment data confirms that single-issuer pools generally outperformed multiple-issuer pools during the summer refinance wave. Most generic single-issuer pools are created by servicers with a history of good prepayment speeds.

The better lenders would lose the, potentially sizable, pay-ups they currently receive for their generic pools, while the multiple-issuer pools would get only marginally better. This would amount to a subsidy of the worse loans already in the multiple-issuer pool. Furthermore, the market would no longer be able to reward lenders with better servicing practices. The FHFA suggests that lenders with good prepayment history would be allowed to make generic single-issuer pools, but maintaining the list of approved lenders would be challenging. Similarly, the proposal would also make it more difficult to introduce new spec pool types, since new types would require FHFA approval through an unspecified process.

Instead the FHFA could require Fannie Mae to take similar steps as Freddie Mac to reduce single-issuer pool production by the worst servicers. Fannie Mae could also implement a program comparable to Freddie Mac’s alignment overflow program. This program is a non-TBA-eligible pooling program for lenders with significantly faster prepayment speeds than average. Both GSEs could use these programs more aggressively than Freddie Mac currently does (only one lender, Impac Mortgage, has ever been included in Freddie Mac’s alignment overflow pools). Such efforts could improve the quality of TBA-deliverable pools without drastic change to the MBS market.