Uncategorized

Prepayment speeds after servicing is sold

admin | July 19, 2019

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

Mortgage servicers clearly have an impact on MBS prepayment speeds, which makes any change in servicers significant. Some servicers proactively alert borrowers to refinance and generally have pools with faster speeds and worse convexity. But loan servicing can be sold, and MBS value can quickly shift if the buyer shows materially faster or slower speeds. Some large originators routinely service their loans for only a few years before selling.

A few large originators only service their loans for a short period

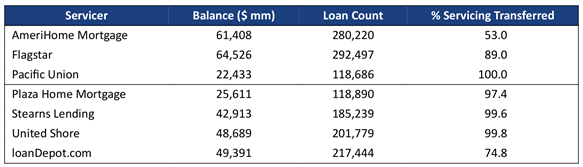

Some originators only service their own loans for a year or two before selling to another servicer. At least seven lenders have sold most of the servicing for agency loans originated from 2014 to 2018 (Exhibit 1). In particular, four servicers—Pacific Union, Stearns Lending, Plaza Home Mortgage, and United Shore—have sold almost 100% of their pre-2018 loan servicing. All of these lenders continued to originate loans in 2018 and 2019. Most of these loans tend to be serviced for 12- to 18-months before sale.

Exhibit 1: Some originators sell most of their servicing relatively quickly

Source: Fannie Mae, Freddie Mac, Ginnie Mae, eMBS, Amherst Pierpont Securities

Speeds can go faster or slower after servicing is sold

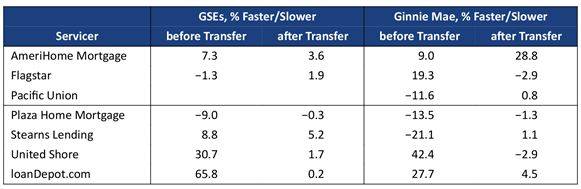

The prepayment performance of these lenders’ pools varies greatly. The Amherst Pierpont servicer ranking report shows that United Shore and loanDepot.com have been extremely fast over the last year, while a lender like Plaza Home Mortgage has tended to be slower (Exhibit 2).

Exhibit 2: Speeds can change after servicing is sold

Source: Fannie Mae, Freddie Mac, Ginnie Mae, eMBS, Amherst Pierpont Securities

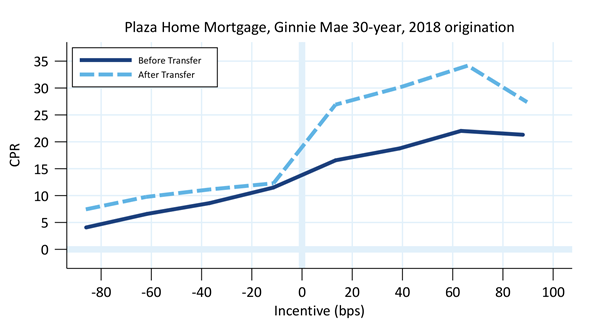

The “before Transfer” columns show the percentage faster or slower a servicer’s loans prepay, compared to a reference cohort of comparable loans. The “after Transfer” columns show the percentage faster or slower the servicing buyers’ prepayment speeds are compared to their reference cohort. For example, Plaza’s Ginnie Mae pools prepaid 13.5% slower than reference over the last 12 months, but they are selling to servicers that only prepaid 1.3% slower. So it is likely that Plaza’s loans would prepay faster after a sale. Prepayment S-curves (Exhibit 3) confirm that Plaza’s 2018 production prepaid faster after the servicing was sold.

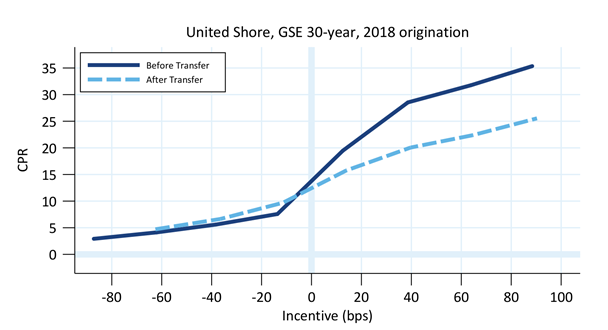

Exhibit 3: United Shore loans slow down after servicing is sold

Source: Fannie Mae, Freddie Mac, Ginnie Mae, eMBS, Amherst Pierpont Securities

On the other hand, United Shore’s loans have prepaid 30.7% faster than the cohorts over the last 12 months. But the lenders acquiring their servicing have only prepaid 0.2% faster than their reference cohorts. So it is likely that United Shore’s speeds fell after the loans were sold, which is confirmed in the S-curves for United Shore’s 2018 production (Exhibit 4).

Exhibit 4: Plaza Mortgage loans speed up after servicing is sold

Source: Fannie Mae, Freddie Mac, Ginnie Mae, eMBS, Amherst Pierpont Securities

Valuing the potential servicing transfer

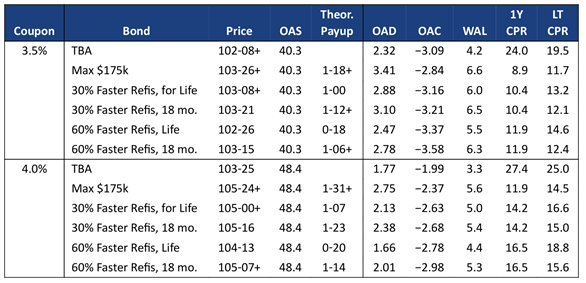

There is a significant valuation difference between assuming the current servicer’s loans continue to prepay faster or slower by the same amount forever, or if a factor like a servicing transfer might change speeds. This is well illustrated by looking at conventional 30-year 3.5% and 4.0% pools with a maximum loan size of $175,000 (Exhibit 5).

Exhibit 5: Theoretical pay-ups for Max $175,000 pools

Source: Fannie Mae, Freddie Mac, Ginnie Mae, eMBS, Amherst Pierpont Securities

The TBA is represented by the June Fannie Major pools, FN MA3692 and FN MA3693. For each coupon, a maximum $175,000 cash window pool (FN CA3863 and FN CA3868) is run at the same OAS to calculate its theoretical pay-up using Yield Book’s prepayment model. The theoretical pay-ups are $1-18+ and $1-31+, both of which are very close to the current pay-ups in the market.

For each coupon a United Shore max $175,000 pool is proxied by running the cash window pools with 1.3 and 1.6 refinance multipliers for the life of the pool. This significantly reduces the theoretical pay-up for the collateral. The pools are also run assuming that the faster speeds persist for the first 18 months, after which they revert to the cohort speed when the servicing is sold.

The theoretical pay-up increases substantially under the servicing transfer scenario compared to the fast speeds for life scenario. For example, assuming United Shore prepays 30% faster for life reduces the spec pay-up by $0-18+, but if speeds slow after 18 months the pay-up is only reduced by $0-06.

Many investors can’t bear the risk of fast near-term prepayments, which keeps prices on collateral from faster servicers low. An investor that can tolerate the faster initial speeds and the uncertainty around timing of a sale could do well by holding pools like this. The price of these pools should jump the instant the servicing is sold (and models should immediately reflect a change to a better servicer by an increase in OAS).