Uncategorized

Brookfield debt looks wide ahead of Oaktree closing

admin | June 28, 2019

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

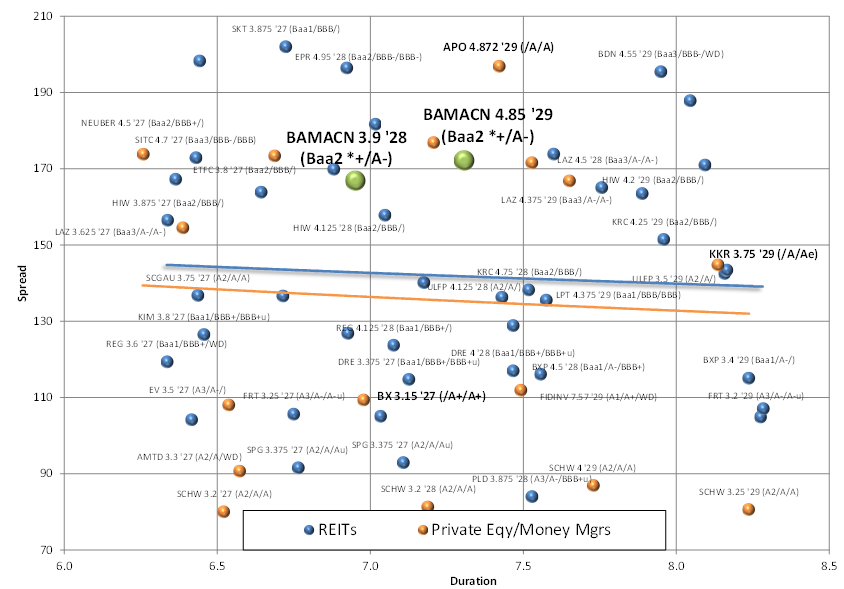

Brookfield Asset Management (BAMACN) 10-year paper is offering a nice pick to both investment grade private equity/investment management credits and REITs. While the company is not a REIT, its ownership of Brookfield Property Partners LP (BRY)—which contains REIT operating subs—makes up a large portion of dividend income. Therefore, bonds should also be compared to REITs, specifically those in the office and retail segments. The BAMACN 3.9% 01/25/28 is currently trading in a +160-155 context, or about +165 to the curve, for a total yield of around 3.60%. The BAMACN 10-year paper could tighten by up to 15 bp on closing of the Oaktree acquisition and the potential ratings upgrade by Moody’s.

Business overview

BAMACN (rated Baa2*+/A-) is an alternative investment manager. Modeled similarly to Berkshire Hathaway (actually referred to by some as “Canada’s Berkshire”), the company holds partial stakes and conducts the majority of its investments in four partnerships that are publicly listed. The primary sectors where investments are focused are in real estate, renewable power, infrastructure, and private equity. The partnerships include Brookfield Property Partners LP (BRY), Brookfield Infrastructure Partners LP (BIP), Brookfield Renewable Partners LP (BEP) and Brookfield Business Partners LP (BBU). In addition to the business it conducts through those ownership interests, BAMACN also generates fee-based revenue through third party asset management, which is currently the fastest growing segment.

Acquisition purpose and financing

Assets under management (AUM) totaled $355 billion as of year-end 2018, $366 billion as of 1Q19, while fee-bearing capital stood at $138 billion on a combined basis. Earlier this year, BAMACN announced the acquisition of a 62% interest in Oaktree Capital Group LLC for $4.7 billion. BAMACN will hold all of Oaktree’s public class A shares and 20% of the insider holdings. The deal will be funded with half stock and half cash, which management has indicated will mostly come from its sizable cash balance ($8.4 billion at year-end, reported as $6.7 billion in 1Q19), meaning they likely will not need to issue debt for this specific purpose. It is expected to close by the end of the third quarter, and will add approximately $120 billion in AUM and $62 billion in fee-bearing capital. BAMACN will inherit just $750 million in debt and $415 million in preferred shares outstanding at Oaktree.

The Oaktree acquisition is unique in that it is a strategic deal being made on BAMACN’s actual balance sheet. The deal is expected to close by 09/30/19. The acquisition will serve to dramatically build out the company’s fee-generating business in credit. Management stated that they made the decision to buy rather than build, as it would take up to a decade to replicate the success of Oaktree. For that reason, Moody’s actually placed their Baa2 rating on review for upgrade with the announcement. The addition of more fee-based income – which the agencies view as more stable than dividend upstreaming from the partnerships – is viewed as a positive for credit, despite the fact that leverage will likely increase initially, to about 3x from mid 2x, and they will utilize some of their available liquidity,

Exhibit 1: Brookfield Asset Management 10-year debt vs private equity / asset managers and REITs

Source: Bloomberg/TRACE BVAL indications, Amherst Pierpont Securities

Brookfield’s ownership structure provides protection for debt holders

BAMACN’s ownership structure means that there is no recourse to BAMACN from the debt held at the individual partnerships. While the owner is expected to lend financial support and make investments, they are under no obligation to do so. A default at any of the partnerships would not constitute a default for BAMACN, or for any of the other partnerships. Therefore, of the roughly $120 billion in debt outstanding across BAMACN and the four partnerships, only the debt held at the parent is ascribed to Brookfield for rating purposes. The adjusted leverage is calculated to be in the mid-2x range and will increase to just under 3x upon closing of the Oaktree deal; which is comparable to similarly rated private equity companies with public debt outstanding. Interestingly, Moody’s does not rate private equity peers APO, BX, CG or KKR; presumably since the privately held partnerships/privately held subs in each respective issuer are viewed as too opaque/complex to rate (or at least not with A ratings). BAMACN’s partnership stakes are in publicly held and individually-rated entities.

BAMACN continues to be highly acquisitive through its core partnership holdings and private equity fund. Notable was the recent $13.2 billion purchase of JCI’s power solution business (auto battery) via Brookfield Business Partners LP, i.e. their private equity fund. Deals of this nature are part of the course of operations and should have no impact to BAMACN’s balance sheet from a bondholders’ perspective. This is no different than the large acquisitions that are regularly made inside the private equity holdings of names like BX or KKR, which do not impact creditors of those names.

The bulk of BAMACN’s income is in the form of dividend payments up-streamed from the four partnerships. Those payouts are made after meeting their own company level debt obligations. Dividend income has still been rather consistent from year-to-year for most of the partnership holdings. The breakdown of revenue in the most recent year was: private equity 61%, properties 17%, infrastructure 12%, and power generation 7%. BAMACN generated over $15 billion in EBITDA last year, $11 billion in the prior year and between $7-10 billion in each of the prior 6 years.

In addition to their estimated current cash balance of $6.7 billion, BAMACN has over $4 billion available on its existing revolving credit facilities (about $1.35 billion drawn), some of which are available through 2024. That liquidity and consistent cash flow compares with just $1.14 billion in maturities next year, $530 million in 2021 and $1.08 billion in 2022.