By the Numbers

Non-QM seniors, CRT deliver quality returns in private MBS

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

Investors at the recent ABS East conference by and large remained upbeat on residential credit, likely with good reason. Certain areas of mortgage credit, namely non-QM seniors and CRT mezzanine and subordinate classes have delivered attractive risk-adjusted returns in the last year, beating those of MBS, investment grade and high yield credit by fairly wide margins.

An analysis of various mortgage credit exposures shows that over the past year, non-QM seniors and mezzanine and subordinate classes of Fannie Mae and Freddie Mac credit risk transfers have delivered the highest risk-adjusted returns beating those posted by bonds across the capital structure in both prime jumbo and seasoned RPLs. The 1-year Sharpe ratio posted by non-QM seniors was substantially better than those of both the aggregate MBS and investment grade corporate bond indices. Mezzanine classes of CRT significantly outperformed the investment grade index as well. While subordinate classes of GSE CRT bonds fared markedly better than the high yield index.

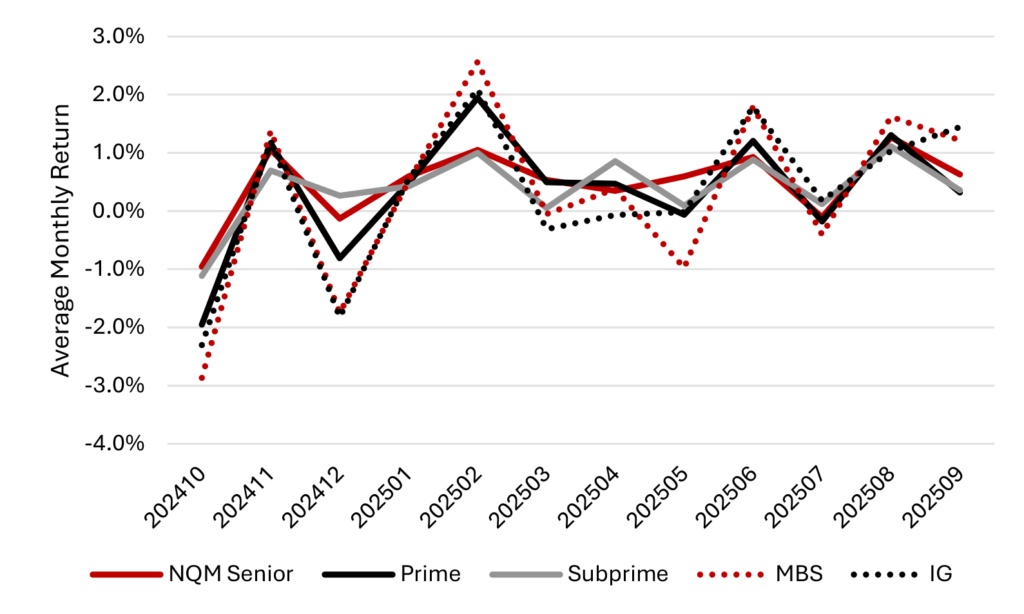

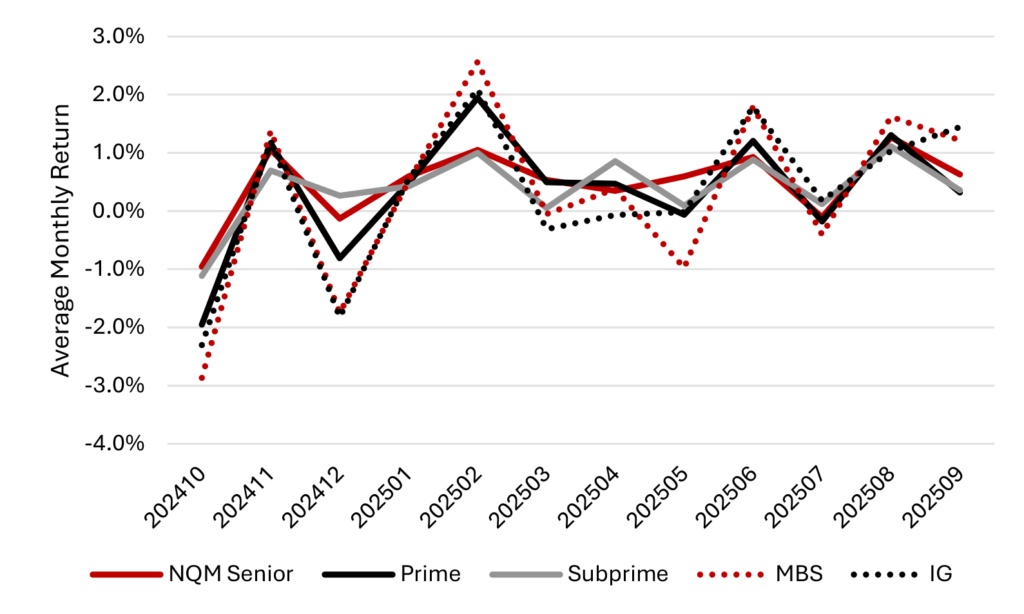

Comparing returns at the top of the capital structure

Despite multi-year low levels of rate volatility, longer duration MBS and corporate indices have struggled to offer substantial returns over the past year when measured on either a nominal or risk-adjusted basis. Over the past 12 months the MBS index has posted an average monthly return of just 28 bp while the broad investment grade index has returned just 32 bp. All RMBS exposures at the top of the capital structure analyzed have delivered better nominal returns than both MBS and investment grade corporates. A cohort comprised of a comprehensive float of ‘AAA’ classes of non-QM securitizations offered an average monthly return of 48 bp while senior classes of deals backed by seasoned re-performing loans and prime collateral returned 40 bp and 37 bp respectively (Figure 1).

Exhibit 1: Senior non-agency RMBS offer better returns than MBS and IG corporates

Source: Santander US Capital Markets, YieldBook MBS & Broad Investment Grade (BIG) Indices

When analyzing returns on a volatility-adjusted basis, the advantage offered by private label RMBS exposures is more pronounced. Non-QM seniors have delivered a 1-year Sharpe ratio of 0.77, 59 bp better than the Sharpe ratio posted by the MBS index and 54 bp better than that of that of the investment grade corporate index (Exhibit 2).

Exhibit 2: Non-QM seniors deliver attractive risk-adjusted returns

Source: Santander US Capital Markets, YieldBook MBS & Broad Investment Grade (BIG) Indices

Non-QM ‘AAA’s have likely outperformed both MBS and corporates for a couple of reasons. Firstly, despite recently depressed observations, rate volatility did spike in both November of last year and in April, fueled by the market’s reaction to tariffs imposed on Liberation Day. As a result, shorter-duration non-QM ‘AAA’s were able to outperform on a relative basis against the backdrop of heightened rate volatility. With that said, the difference in duration between non-QM ‘AAA’s and MBS and corporate indices is not as pronounced as it has been in the past as much of the outstanding cohort is comprised of lower coupon bonds backed by slow paying, low WAC collateral that are unlikely to be called.

Secondly, and somewhat counterintuitively, non-QM spreads may have a firmer backstop than agency MBS and investment grade corporate spreads given the current structure of the private label market. Unlike in the past, when the overwhelming majority of non-conforming loans were earmarked for securitization, a large swath of non-conforming origination is now funded via a combination of Federal Home Loan Bank advances and annuity issuance by life insurance companies. This stickier and more stable form of financing has proven to be somewhat of a governor to how much loan spreads can widen into bouts of spread volatility as large insurance buyers have continued to fund whole loan purchases, effectively capping implied ‘AAA’ execution.

GSE CRT still offers attractive risk-adjusted returns but prospects may be weakening

Uncapped, floating-rate structured product exposures such as CLOs and GSE CRT have consistently delivered attractive risk-adjusted returns to investors. One-year Sharpe ratios posted by both CRT mezzanine and subordinate bonds both doubled the volatility-adjusted return posted by the high yield index. CRT subordinate and mezzanine bonds delivered Sharpe ratios of 1.36 and 1.31 respectively with the high yield index posting a return of just 64 bp. While GSE CRT bonds continue to offer attractive risk-adjusted returns, they have been capped to some degree as the enterprises have introduced shorter-dated par call options which have limited potential price appreciation. Furthermore, the enterprises have limited or in some cases discontinued issuing longer spread duration, deeper subordinate bonds, further limiting potential price appreciation into a rally in credit spreads (Exhibit 3).

Exhibit 3: Stacking up risk adjusted returns across mezzanine and subordinate RMBS

Source: Santander US Capital Markets, YieldBook MBS & Broad Investment Grade (BIG) Indices

Over the past year, subordinate classes of non-QM deals have offered the highest Sharpe ratio across all other residential credit exposures. Returns across deeper subordinate classes of non-QM deals have been fueled, to some degree, by an uptick in call activity by sponsors, pulling deeply discounted non-investment grade classes of these deals to par. Investors in these classes may continue to benefit from this price appreciation as more 2022 and 2023 vintage deals become callable.

This material is intended only for institutional investors and does not carry all of the independence and disclosure standards of retail debt research reports. In the preparation of this material, the author may have consulted or otherwise discussed the matters referenced herein with one or more of SCM’s trading desks, any of which may have accumulated or otherwise taken a position, long or short, in any of the financial instruments discussed in or related to this material. Further, SCM may act as a market maker or principal dealer and may have proprietary interests that differ or conflict with the recipient hereof, in connection with any financial instrument discussed in or related to this material.

This message, including any attachments or links contained herein, is subject to important disclaimers, conditions, and disclosures regarding Electronic Communications, which you can find at https://portfolio-strategy.apsec.com/sancap-disclaimers-and-disclosures.

Important Disclaimers

Copyright © 2025 Santander US Capital Markets LLC and its affiliates (“SCM”). All rights reserved. SCM is a member of FINRA and SIPC. This material is intended for limited distribution to institutions only and is not publicly available. Any unauthorized use or disclosure is prohibited.

In making this material available, SCM (i) is not providing any advice to the recipient, including, without limitation, any advice as to investment, legal, accounting, tax and financial matters, (ii) is not acting as an advisor or fiduciary in respect of the recipient, (iii) is not making any predictions or projections and (iv) intends that any recipient to which SCM has provided this material is an “institutional investor” (as defined under applicable law and regulation, including FINRA Rule 4512 and that this material will not be disseminated, in whole or part, to any third party by the recipient.

The author of this material is an economist, desk strategist or trader. In the preparation of this material, the author may have consulted or otherwise discussed the matters referenced herein with one or more of SCM’s trading desks, any of which may have accumulated or otherwise taken a position, long or short, in any of the financial instruments discussed in or related to this material. Further, SCM or any of its affiliates may act as a market maker or principal dealer and may have proprietary interests that differ or conflict with the recipient hereof, in connection with any financial instrument discussed in or related to this material.

This material (i) has been prepared for information purposes only and does not constitute a solicitation or an offer to buy or sell any securities, related investments or other financial instruments, (ii) is neither research, a “research report” as commonly understood under the securities laws and regulations promulgated thereunder nor the product of a research department, (iii) or parts thereof may have been obtained from various sources, the reliability of which has not been verified and cannot be guaranteed by SCM, (iv) should not be reproduced or disclosed to any other person, without SCM’s prior consent and (v) is not intended for distribution in any jurisdiction in which its distribution would be prohibited.

In connection with this material, SCM (i) makes no representation or warranties as to the appropriateness or reliance for use in any transaction or as to the permissibility or legality of any financial instrument in any jurisdiction, (ii) believes the information in this material to be reliable, has not independently verified such information and makes no representation, express or implied, with regard to the accuracy or completeness of such information, (iii) accepts no responsibility or liability as to any reliance placed, or investment decision made, on the basis of such information by the recipient and (iv) does not undertake, and disclaims any duty to undertake, to update or to revise the information contained in this material.

Unless otherwise stated, the views, opinions, forecasts, valuations, or estimates contained in this material are those solely of the author, as of the date of publication of this material, and are subject to change without notice. The recipient of this material should make an independent evaluation of this information and make such other investigations as the recipient considers necessary (including obtaining independent financial advice), before transacting in any financial market or instrument discussed in or related to this material.

Important disclaimers for clients in the EU and UK

This publication has been prepared by Trading Desk Strategists within the Sales and Trading functions of Santander US Capital Markets LLC (“SanCap”), the US registered broker-dealer of Santander Corporate & Investment Banking. This communication is distributed in the EEA by Banco Santander S.A., a credit institution registered in Spain and authorised and regulated by the Bank of Spain and the CNMV. Any EEA recipient of this communication that would like to affect any transaction in any security or issuer discussed herein should do so with Banco Santander S.A. or any of its affiliates (together “Santander”). This communication has been distributed in the UK by Banco Santander, S.A.’s London branch, authorised by the Bank of Spain and subject to regulatory oversight on certain matters by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA).

The publication is intended for exclusive use for Professional Clients and Eligible Counterparties as defined by MiFID II and is not intended for use by retail customers or for any persons or entities in any jurisdictions or country where such distribution or use would be contrary to local law or regulation.

This material is not a product of Santander´s Research Team and does not constitute independent investment research. This is a marketing communication and may contain ¨investment recommendations¨ as defined by the Market Abuse Regulation 596/2014 ("MAR"). This publication has not been prepared in accordance with legal requirements designed to promote the independence of research and is not subject to any prohibition on dealing ahead of the dissemination of investment research. The author, date and time of the production of this publication are as indicated herein.

This publication does not constitute investment advice and may not be relied upon to form an investment decision, nor should it be construed as any offer to sell or issue or invitation to purchase, acquire or subscribe for any instruments referred herein. The publication has been prepared in good faith and based on information Santander considers reliable as of the date of publication, but Santander does not guarantee or represent, express or implied, that such information is accurate or complete. All estimates, forecasts and opinions are current as at the date of this publication and are subject to change without notice. Unless otherwise indicated, Santander does not intend to update this publication. The views and commentary in this publication may not be objective or independent of the interests of the Trading and Sales functions of Santander, who may be active participants in the markets, investments or strategies referred to herein and/or may receive compensation from investment banking and non-investment banking services from entities mentioned herein. Santander may trade as principal, make a market or hold positions in instruments (or related derivatives) and/or hold financial interest in entities discussed herein. Santander may provide market commentary or trading strategies to other clients or engage in transactions which may differ from views expressed herein. Santander may have acted upon the contents of this publication prior to you having received it.

This publication is intended for the exclusive use of the recipient and must not be reproduced, redistributed or transmitted, in whole or in part, without Santander’s consent. The recipient agrees to keep confidential at all times information contained herein.