Uncategorized

Picking pools to avoid Ginnie Mae buyouts

admin | September 11, 2020

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

The prospect of fast prepayments from buyouts of delinquent loans is complicating decisions to invest in Ginnie Mae MBS, and the spread between Ginnie Mae and conventional MBS has collapsed. Some large banks have aggressively bought out loans, driving up prepayment speeds in June and July. Most other servicers have large delinquent pipelines that investors fear could be bought out at any time. This complicates the investment decision because some servicers have more than 10% of their loans eligible for buyout. One way to avoid this risk is to focus on servicers with low current delinquency rates, low buyouts or both. That puts an investor in pools with less risk than the market has priced.

Ginnie Mae servicers are permitted to buyout loans at par as soon as they become 90 days delinquent. Before July, Ginnie Mae allowed loans that cured to be re-pooled immediately. Servicers anticipated the opportunity of buying out loans at par and re-pooling at a significant premium. Prior estimates, discussed in this article, suggest that banks could have earned 339% annualized return on buyouts, and non-banks earned 296% returns.

To protect investors from fast prepayments Ginnie Mae instituted pooling restrictions in July that sharply reduced the economics of re-pooling these loans. The new rules required servicers to hold loans on balance sheets for at least six months before re-pooling and prohibited delivering these loans into TBA-eligible pools. These changes lowered annualized returns to an estimated 61% for banks and 18% for non-banks.

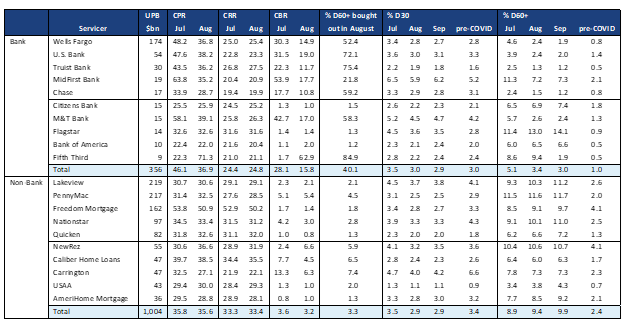

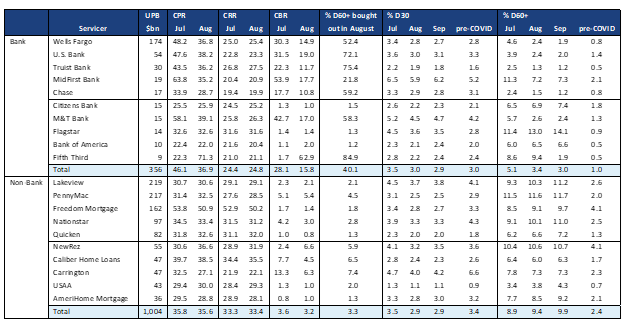

Banks continued to buyout delinquent loans in July and August (Exhibit 1). However, the high buyout banks like Wells Fargo and Chase have very few delinquent loans left to buyout so the overall effect on prepayment speeds is shrinking. But a few other banks, and almost every large non-bank servicer, has a very large portion of their loans eligible for buyout.

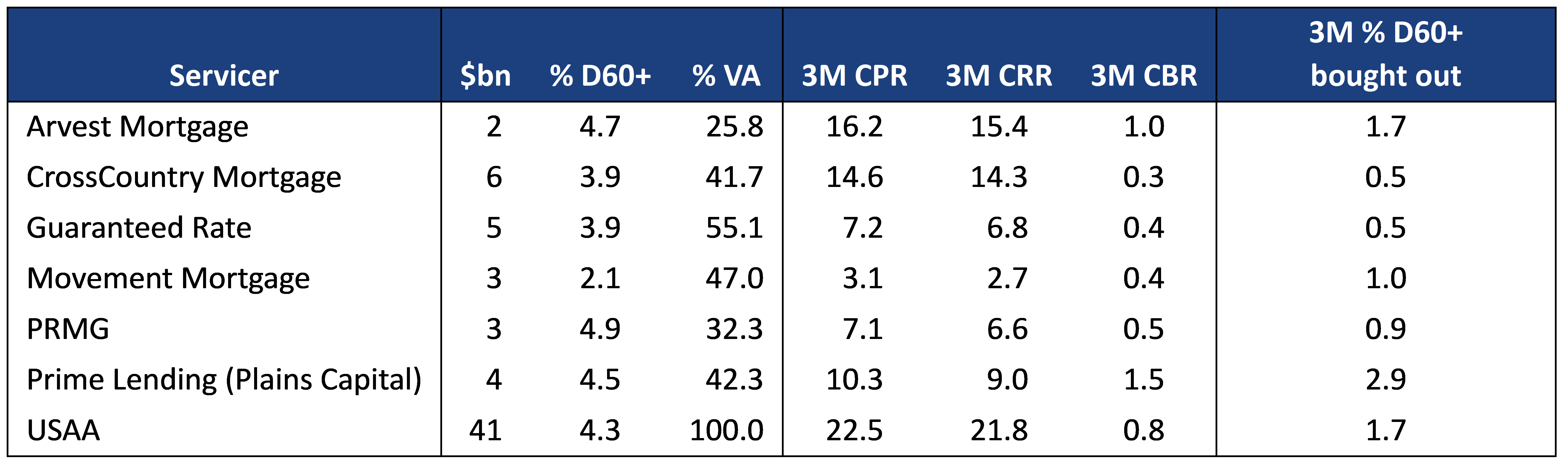

Exhibit 1: Non-bank delinquencies are building

CRR: Conditional Repayment Rate (housing turnover and refinancing). CBR: Conditional Buyout Rate. Source: Ginnie Mae, eMBS, Amherst Pierpont Securities

Although non-bank buyouts have been low, there is no guarantee this will remain the same. One possibility is a bank could acquire MSR from a non-bank and finance the buyout themselves, sharing in the profits. Also, the FHA just announced that some borrowers can be refinanced as soon as forbearance ends. Servicers will be in contact with borrowers when they call for forbearance extensions or exit forbearance, and servicers might find it worthwhile to offer a payment deferral to cure the delinquency and then a refinance. The refinance would benefit the borrower with a lower payment and the servicer can still make good money on the refinance.

The best way to avoid this risk is to look for Ginnie Mae servicers that have not bought out many loans but also have low delinquency rates. One servicer that stands out is USAA. Their 60+ day delinquency rate is very low compared to other non-bank servicers although they haven’t bought out many loans. Rather, their delinquency rate is low because they have had fewer loans become delinquent throughout this crisis. This suggests USAA pools could perform much better than other servicers’ pools if there is a second wave of Covid-19 that triggers new delinquencies.

One concern with USAA is that they service only VA loans, which typically exhibit very negative convexity. However, USAA loans tend to prepay more slowly than other VA lenders’ loans. The Amherst Pierpont servicer prepayment ranking shows that USAA loans typically prepay almost 50% below comparable VA loans from other lenders. Another concern is that most VA delinquent loans are likely to require loan modifications, which mandates a buyout, whereas FHA loans might cure and remain in the pool if servicers are unable to finance the buyouts.

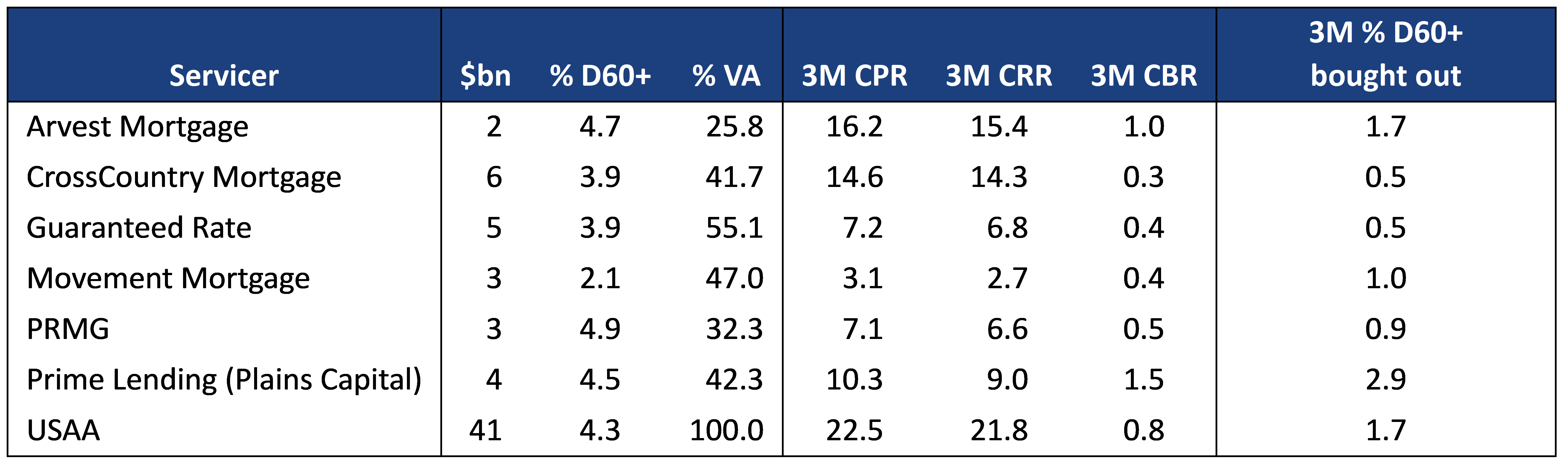

There are a few other, smaller, non-bank servicers that have not been buying out delinquent loans, yet have low delinquency rates (Exhibit 2). For example, CrossCountry Mortgage has only 3.9% of their loans at least 60 days delinquent and buyout rates have averaged only 0.3 CPR over the past 3 months. Their pools should have far less buyout risk than the multi pools.

Exhibit 2: A few servicers have low delinquency and buyout rates

Prepayment speeds and %60+ bough out averaged over June, July, and August. CRR: Conditional Repayment Rate (housing turnover and refinancing). CBR: Conditional Buyout Rate. Source: Ginnie Mae, eMBS, Amherst Pierpont Securities

Another way to avoid buyouts is to buy pools backed by the banks that have conducted heavy buyouts and have very few delinquent loans remaining. For example, Wells Fargo pools have only 1.9% of their loans at least 60 days delinquent. However, these pools are exposed to the risk of a second wave since any new delinquencies are likely to be rapidly bought out.

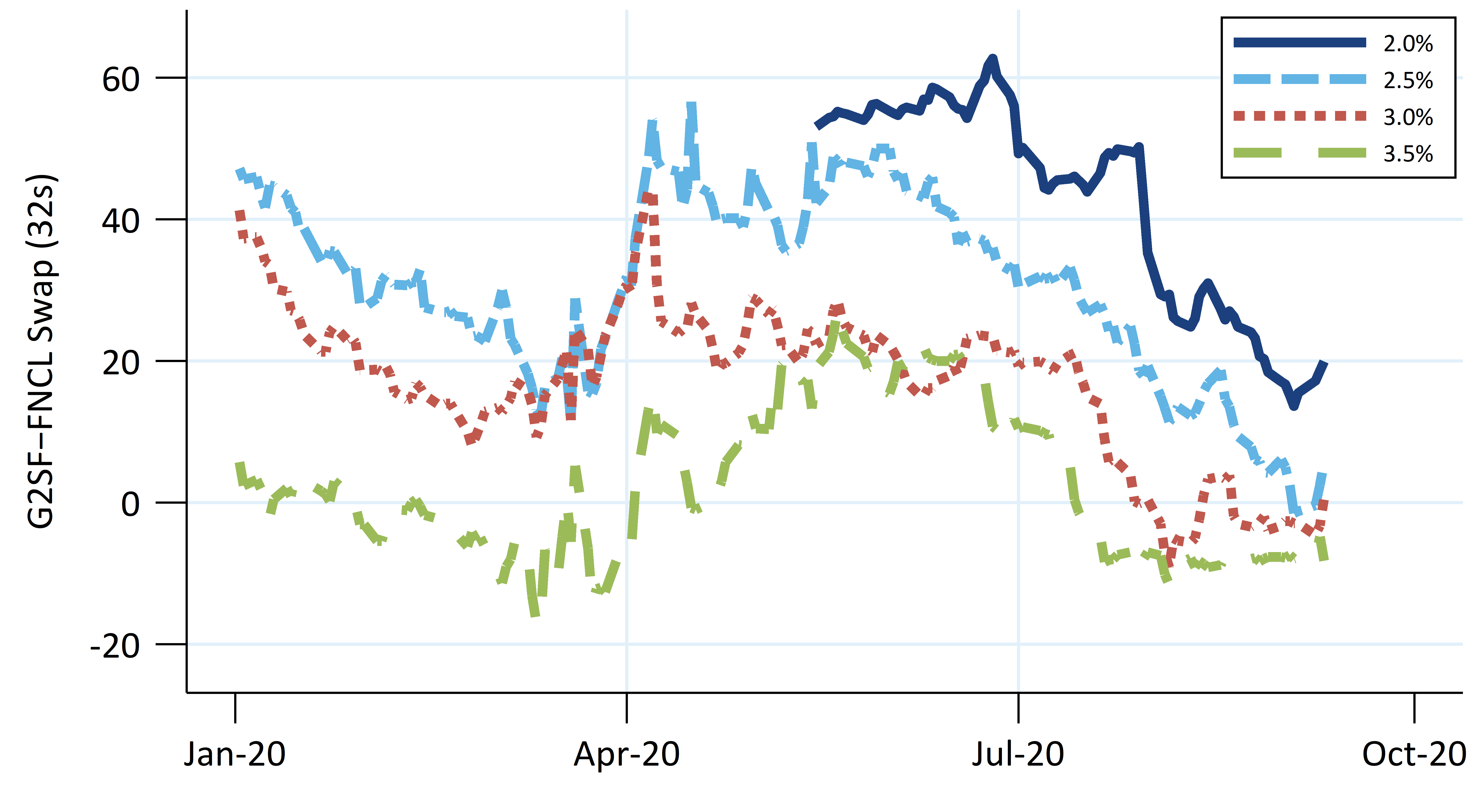

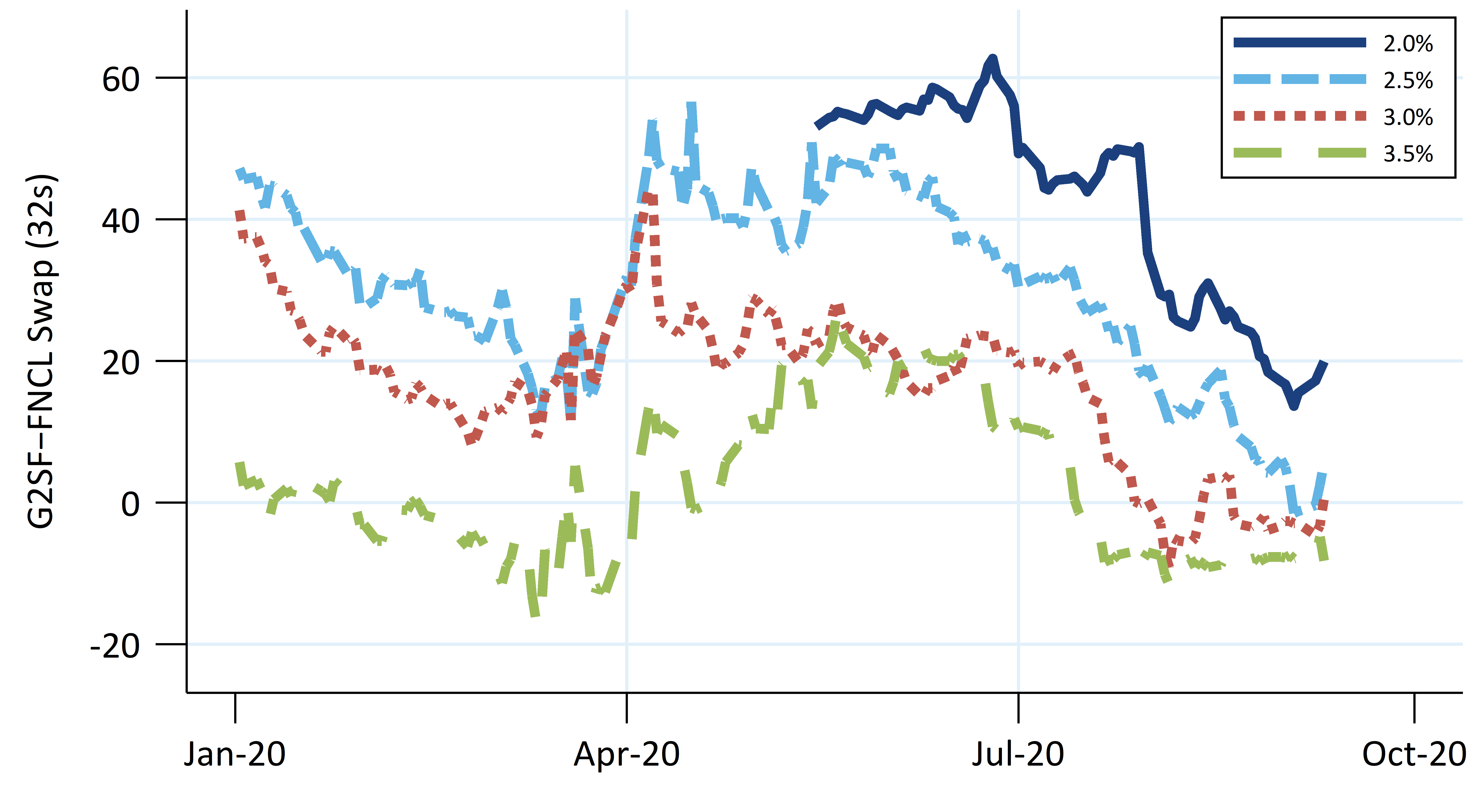

Prices for Ginnie Mae MBS suggest that the buyout risk is already priced in. The Ginnie–Fannie MBS swap has fallen sharply since the beginning of June as investors became worried about the risk of buyouts (Exhibit 3). The 2.5% and 3.0% swaps are currently at the lows for the year. The 3.0% and 3.5% swaps have been trading relatively flat for most of August, suggesting buyout risk has been priced in. By selecting a servicer with low delinquencies, a low tendency to buyout delinquent loans or both, investors can own Ginnie Mae pools inexpensively relative to conventional pools without taking the full risk currently priced into the swap.

Exhibit 3: The Ginnie–Fannie swap has plummeted throughout the summer

Source: Yield Book, Amherst Pierpont Securities

This material is intended only for institutional investors and does not carry all of the independence and disclosure standards of retail debt research reports. In the preparation of this material, the author may have consulted or otherwise discussed the matters referenced herein with one or more of SCM’s trading desks, any of which may have accumulated or otherwise taken a position, long or short, in any of the financial instruments discussed in or related to this material. Further, SCM may act as a market maker or principal dealer and may have proprietary interests that differ or conflict with the recipient hereof, in connection with any financial instrument discussed in or related to this material.

This message, including any attachments or links contained herein, is subject to important disclaimers, conditions, and disclosures regarding Electronic Communications, which you can find at https://portfolio-strategy.apsec.com/sancap-disclaimers-and-disclosures.

Important Disclaimers

Copyright © 2025 Santander US Capital Markets LLC and its affiliates (“SCM”). All rights reserved. SCM is a member of FINRA and SIPC. This material is intended for limited distribution to institutions only and is not publicly available. Any unauthorized use or disclosure is prohibited.

In making this material available, SCM (i) is not providing any advice to the recipient, including, without limitation, any advice as to investment, legal, accounting, tax and financial matters, (ii) is not acting as an advisor or fiduciary in respect of the recipient, (iii) is not making any predictions or projections and (iv) intends that any recipient to which SCM has provided this material is an “institutional investor” (as defined under applicable law and regulation, including FINRA Rule 4512 and that this material will not be disseminated, in whole or part, to any third party by the recipient.

The author of this material is an economist, desk strategist or trader. In the preparation of this material, the author may have consulted or otherwise discussed the matters referenced herein with one or more of SCM’s trading desks, any of which may have accumulated or otherwise taken a position, long or short, in any of the financial instruments discussed in or related to this material. Further, SCM or any of its affiliates may act as a market maker or principal dealer and may have proprietary interests that differ or conflict with the recipient hereof, in connection with any financial instrument discussed in or related to this material.

This material (i) has been prepared for information purposes only and does not constitute a solicitation or an offer to buy or sell any securities, related investments or other financial instruments, (ii) is neither research, a “research report” as commonly understood under the securities laws and regulations promulgated thereunder nor the product of a research department, (iii) or parts thereof may have been obtained from various sources, the reliability of which has not been verified and cannot be guaranteed by SCM, (iv) should not be reproduced or disclosed to any other person, without SCM’s prior consent and (v) is not intended for distribution in any jurisdiction in which its distribution would be prohibited.

In connection with this material, SCM (i) makes no representation or warranties as to the appropriateness or reliance for use in any transaction or as to the permissibility or legality of any financial instrument in any jurisdiction, (ii) believes the information in this material to be reliable, has not independently verified such information and makes no representation, express or implied, with regard to the accuracy or completeness of such information, (iii) accepts no responsibility or liability as to any reliance placed, or investment decision made, on the basis of such information by the recipient and (iv) does not undertake, and disclaims any duty to undertake, to update or to revise the information contained in this material.

Unless otherwise stated, the views, opinions, forecasts, valuations, or estimates contained in this material are those solely of the author, as of the date of publication of this material, and are subject to change without notice. The recipient of this material should make an independent evaluation of this information and make such other investigations as the recipient considers necessary (including obtaining independent financial advice), before transacting in any financial market or instrument discussed in or related to this material.

Important disclaimers for clients in the EU and UK

This publication has been prepared by Trading Desk Strategists within the Sales and Trading functions of Santander US Capital Markets LLC (“SanCap”), the US registered broker-dealer of Santander Corporate & Investment Banking. This communication is distributed in the EEA by Banco Santander S.A., a credit institution registered in Spain and authorised and regulated by the Bank of Spain and the CNMV. Any EEA recipient of this communication that would like to affect any transaction in any security or issuer discussed herein should do so with Banco Santander S.A. or any of its affiliates (together “Santander”). This communication has been distributed in the UK by Banco Santander, S.A.’s London branch, authorised by the Bank of Spain and subject to regulatory oversight on certain matters by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA).

The publication is intended for exclusive use for Professional Clients and Eligible Counterparties as defined by MiFID II and is not intended for use by retail customers or for any persons or entities in any jurisdictions or country where such distribution or use would be contrary to local law or regulation.

This material is not a product of Santander´s Research Team and does not constitute independent investment research. This is a marketing communication and may contain ¨investment recommendations¨ as defined by the Market Abuse Regulation 596/2014 ("MAR"). This publication has not been prepared in accordance with legal requirements designed to promote the independence of research and is not subject to any prohibition on dealing ahead of the dissemination of investment research. The author, date and time of the production of this publication are as indicated herein.

This publication does not constitute investment advice and may not be relied upon to form an investment decision, nor should it be construed as any offer to sell or issue or invitation to purchase, acquire or subscribe for any instruments referred herein. The publication has been prepared in good faith and based on information Santander considers reliable as of the date of publication, but Santander does not guarantee or represent, express or implied, that such information is accurate or complete. All estimates, forecasts and opinions are current as at the date of this publication and are subject to change without notice. Unless otherwise indicated, Santander does not intend to update this publication. The views and commentary in this publication may not be objective or independent of the interests of the Trading and Sales functions of Santander, who may be active participants in the markets, investments or strategies referred to herein and/or may receive compensation from investment banking and non-investment banking services from entities mentioned herein. Santander may trade as principal, make a market or hold positions in instruments (or related derivatives) and/or hold financial interest in entities discussed herein. Santander may provide market commentary or trading strategies to other clients or engage in transactions which may differ from views expressed herein. Santander may have acted upon the contents of this publication prior to you having received it.

This publication is intended for the exclusive use of the recipient and must not be reproduced, redistributed or transmitted, in whole or in part, without Santander’s consent. The recipient agrees to keep confidential at all times information contained herein.